Topic: financial inclusion

-

Pintarnya Secures $16.7M to Boost Indonesian Jobs and Financial Access

Pintarnya, an Indonesian platform for job seekers and financial solutions, raised $16.7 million in Series A funding led by Square Peg with support from existing investors. The platform uses AI-powered job matching and offers secured loans through asset-backed lenders, targeting Indonesia's large ...

Read More » -

Egypt's MNT-Halan Targets GCC's Underserved Market with Expansion

MNT-Halan is expanding in GCC nations, targeting underserved consumers in the UAE and Saudi Arabia to increase access to digital financial services. The company has grown rapidly, gaining 1.5 million users and offering loans, salary advances, and auto loans through strategic partnerships. Leverag...

Read More » -

Al Fardan Exchange & ABHI Launch Salary Advance for Financial Access

A new Salary Advance service in the UAE, launched by Al Fardan Exchange and Abhi Middle East, allows WPS-registered workers to access up to half of their earned wages early via the AlfaPay app or over 90 branches. The initiative aims to enhance financial inclusion and stability by helping underba...

Read More » -

ADX Group Unveils 3 AI Tools to Simplify Investing

The Abu Dhabi Securities Exchange (ADX) has launched three AI tools—AI Financial Insight, AI Court Order Agent, and TAMM for ADX Investors—to simplify investing and enhance market accessibility for millions in the UAE. These tools, developed with TAMM and judicial bodies, streamline services by p...

Read More » -

Iraq's Digital Finance Leap Earns World Bank Praise

Iraq has received World Bank praise for rapidly expanding electronic payment systems and financial inclusion initiatives, demonstrating commitment to modernizing its banking sector. Electronic transactions exceeded $1.52 billion in August 2024, with 20 million payment cards in circulation reachin...

Read More » -

Money Fellows Hits $1.5B in Digital Savings Transactions

Money Fellows, an Egyptian fintech, has processed over $1.5 billion in digital savings transactions and attracted more than eight million users, digitizing informal savings circles into secure financial tools. The platform offers a fully integrated experience with digital savings groups, smart sa...

Read More » -

SNB, Tarabut & Geidea Launch New SME Lending Platform

A new POS financing platform for SMEs in Saudi Arabia is being launched by a partnership between Saudi National Bank, Tarabut, and Geidea, pending central bank approval. This initiative supports Saudi Vision 2030 by providing faster, integrated access to working capital for SMEs through Geidea's ...

Read More » -

Paysky Unveils Revolutionary Fintech Solutions at MTN Summit 2025

The MTN Fintech Summit 2025 in Johannesburg highlighted Paysky's advanced digital payment solutions and its strategic partnership with MTN Group to expand financial services across Africa. Paysky and MTN are collaborating to scale the MoMo platform, aiming to connect merchants and consumers acros...

Read More » -

WOLIZ to Digitally Equip 90,000 Moroccan Merchants in New Deal

A partnership between WOLIZ and Morocco's Ministry of Industry and Trade will digitally empower 90,000 merchants, providing 20,000 nanostores with connected terminals and access to a digital platform to modernize retail. The initiative aims to strengthen small shopkeepers by offering digital tool...

Read More » -

Valu & MobileMasr Launch Egypt's First P2P BNPL for Used Phones

Valu and MobileMasr have launched Egypt's first peer-to-peer Buy-Now, Pay-Later service for used smartphones, combining flexible payment options with device verification. The service ensures security through identity checks, GPS validation, secure payments, and electronic contracts, with sellers ...

Read More » -

Vodafone Oman & Software Group Boost Digital Financial Services

Vodafone Oman partners with Software Group to develop next-generation digital financial services, aiming to accelerate Oman's digital economy and enhance financial inclusion. The collaboration utilizes Software Group's DigiWave Digital Banking Platform and digital channels to provide tailored fin...

Read More » -

MoneyHash & Tabby Launch BNPL for MEA Merchants

MoneyHash and Tabby have partnered to launch a buy now, pay later (BNPL) solution for merchants in the Middle East and Africa, enabling quick integration through MoneyHash's unified API. The collaboration allows e-commerce businesses to offer Tabby's interest-free installment plans at checkout, a...

Read More » -

The Great Banking Collision: DeFi Meets Mainstream

Decentralized finance (DeFi) and traditional banking are converging, reshaping financial services through blockchain technology and smart contracts, offering speed, affordability, and global access. This integration challenges traditional banking by eliminating intermediaries, prompting banks to ...

Read More » -

du & talabat Launch UAE's First Digital Wallet for Delivery Riders

du Pay and talabat have launched the UAE's first licensed digital wallet specifically for delivery riders, marking a pioneering partnership between a digital wallet provider and a major delivery platform. The wallet enables instant salary access, bill payments, international remittances, and mobi...

Read More » -

O Gold Wins Best Shariah Gold Investment App at Global Takaful Awards 2025

O Gold won the "Best Shariah Compliant Gold Investment App" award at the Global Takaful & Re-Takaful Awards 2025, recognizing its leadership in ethical FinTech innovation. The Emirati platform democratizes access to Shariah-compliant precious metal investments, allowing fractional ownership start...

Read More » -

From Traditional to AI: The Evolution of Credit Risk Analysis

Credit risk analysis has evolved from manual methods to AI-driven systems using real-time data to address global debt, regulations, and data growth. The shift includes digitization, alternative data sources, and machine learning for faster, more accurate, and inclusive risk assessments. Challenge...

Read More » -

Sarmad Launches Thamar to Simplify Saudi Investor Services

Sarmad has launched thamar, a digital platform designed to modernize investor services for asset management firms in Saudi Arabia, aligning with Vision 2030 to enhance financial digitization. The platform streamlines operations by connecting asset managers with distributors, digitizing workflows,...

Read More » -

Morocco to Digitize 50,000 Retail Stores with Z.systems

The Moroccan government is partnering with Z.systems to digitally modernize 50,000 local shops, enhancing their competitiveness as part of the national strategy leading up to the 2030 World Cup. Shopkeepers will receive digital tools that streamline operations, connect them with major distributor...

Read More » -

Alipay+ Expands to Saudi Arabia, Enabling QR Payments for Merchants

The Saudi Central Bank and Ant International are partnering to introduce cross-border QR payments by 2026, enhancing financial inclusion and supporting Saudi Vision 2030. This integration will allow Saudi merchants to accept payments from over 1.7 billion users across 36 digital wallets, boosting...

Read More » -

ABHI & TRAY Unite to Empower Saudi Arabia's Hospitality Workforce

A new partnership between ABHI and TRAY introduces Earned Wage Access (EWA) to Saudi Arabia's food and beverage industry, allowing employees early access to earned wages and reducing reliance on high-interest loans. This collaboration supports Saudi Vision 2030 by enhancing financial inclusion an...

Read More » -

Flipkart Super.money & Kotak811 Launch Free UPI Payments

Super.money and Kotak Mahindra Bank have partnered to launch an integrated account combining UPI payments, savings, and secured credit cards, aiming to achieve profitability by 2026 through enhanced customer engagement. The collaboration targets distributing two million secured credit cards in th...

Read More » -

Ooredoo Fintech & PayPal Boost Global Digital Payments

Ooredoo Fintech and PayPal have partnered to integrate Ooredoo Wallet with PayPal World, creating a unified global payments network for the MENA region. This collaboration enables users to connect with nearly two billion consumers worldwide, facilitating international money transfers and access t...

Read More » -

Saudi's UmrahCash Enters Indonesia via Sharia Partnerships

UmrahCash has launched in Indonesia with strategic partnerships to enhance the sharia fintech ecosystem for pilgrims, aiming to support millions undertaking hajj and umrah annually. The company provides secure, transparent, and sharia-compliant financial services, including direct access to Saudi...

Read More » -

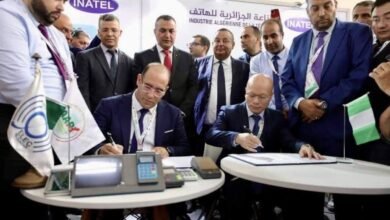

Algeria Inks $300M Deal to Supply 2M Payment Terminals to Nigeria

Algeria has signed a $300 million deal to supply Nigeria with two million electronic payment terminals, enhancing regional economic and technological cooperation. The terminals will be manufactured in Algeria by Inatel in partnership with Morefun Electronic Technology, showcasing Algeria's growin...

Read More » -

Ex-Microsoft & Uber Founder Raises $3M for Neobank Munify, Backed by YC

Munify is a neobank founded by Khalid Ashmawy to address the slow and costly process of sending remittances to Egypt, inspired by his personal frustrations with high fees and delays. The company has secured $3 million in seed funding and joined Y Combinator's Summer 2025 cohort, offering instant,...

Read More » -

WE-Elevate Unites DCO and Members to Boost Women in Digital Business

The Digital Cooperation Organization (DCO) is fully expanding its WE-Elevate program to all Member States to empower women entrepreneurs by providing tools for thriving online. The program, successfully piloted in Rwanda, offers digital capacity-building through online learning, mentoring, and e-...

Read More » -

STC Bank Launches Smart Saver & Finance Tools for Customers

STC Bank has launched two Shariah-compliant digital tools, Smart Saver and Smart Finance, to simplify saving and provide flexible financing while adhering to Islamic banking principles. Smart Saver helps customers build savings automatically through round-ups and recurring transfers, offering com...

Read More » -

Bosta & e& Partner to Transform Egypt's Fintech-Logistics

Bosta and e& have formed a strategic alliance to merge digital payments with logistics, aiming to create an integrated tech ecosystem that benefits merchants and improves customer experiences. The partnership focuses on accelerating cash flow for merchants, promoting financial inclusion, and prov...

Read More » -

MTN Crowned Africa's Top Telecom Employer by Forbes

MTN Group was recognized as Africa's top telecommunications employer and third globally in the Forbes World’s Best Employers 2025 list, ranking 166th overall and excelling in the telecom category. The accolade was based on extensive surveys of over 300,000 workers evaluating factors like culture,...

Read More » -

Flutterwave Acquires Nigerian Fintech Mono in Landmark Deal

Flutterwave, Africa's largest fintech firm, has acquired open banking startup Mono in a significant all-stock deal, uniting two key infrastructure providers to offer a more comprehensive service suite. Mono provides critical APIs that allow secure sharing of bank data, addressing the lack of stan...

Read More » -

Tarabut Opens New Regional Headquarters in Riyadh

Tarabut has launched its new regional headquarters in Riyadh, reinforcing its commitment to Saudi Arabia's open banking framework and Vision 2030 economic goals. The inauguration involved key Saudi banks and partners, showcasing Tarabut's integration and collaborative role within the Kingdom's fi...

Read More » -

Egypt's Mobile Wallet Transactions Soar 80% to Record EGP 943 Billion in Q2 2025

Egypt's mobile wallet sector saw significant growth, with transaction volume rising 80% year-on-year to 718 million and value increasing 72% to EGP 943 billion in Q2 2025. Vodafone Cash led the market with 55% of all wallets and dominated transaction volume and value, while peer-to-peer transfers...

Read More » -

EMURGO and Pravica Partner to Bring Cardano Stablecoins to Sui Blockchain

EMURGO Labs and Pravica are partnering to bring Cardano's native stablecoins to the Sui blockchain, enhancing cross-chain interoperability and expanding their use in global financial services. The collaboration will utilize Pravica's S3.Money platform to integrate these stablecoins into worldwide...

Read More » -

Pakistani Fintechs Chase Saudi Arabia's Vision 2030 Opportunity

Pakistan's fintech sector is expanding into Saudi Arabia, supported by Vision 2030 and stronger bilateral ties, with the goal of establishing Pakistan as a key regional IT hub. The Money 20/20 event in Riyadh acted as a launchpad for Pakistani firms, enabling business deals, investment attraction...

Read More »