Netflix’s Warner Bros. Deal Could Change Your TV Remote

▼ Summary

– Netflix enforces strict technical and promotional requirements on TV manufacturers, including a mandatory remote button and prominent app placement, to be certified as “Netflix Ready.”

– The company’s market dominance, accounting for 19% of North American streaming, forces device makers to accept these terms to avoid commercial failure.

– Netflix restricts data sharing with smart TV platforms, preventing its content from appearing in universal recommendations, watchlists, or voice search results from other services.

– Its financial agreements with TV platforms are unique, as it does not share subscriber revenue or participate in third-party subscription marketplaces like other streamers.

– Following its acquisition of Warner Bros., industry insiders speculate Netflix may integrate HBO Max into its app, potentially increasing its leverage over device makers, though regulatory scrutiny could force policy changes.

When you purchase a new television, the array of choices can be overwhelming, from display technology to the operating system powering the interface. Yet, one element remains remarkably consistent across nearly every model: the prominent placement of the Netflix app and a dedicated Netflix button on the remote control. This uniformity is no accident, but the result of strict certification requirements imposed by the streaming giant on television manufacturers. As Netflix moves to acquire Warner Bros. and its HBO Max service, industry observers are questioning how this consolidation might reshape the rules governing our smart TV experiences and the data they share.

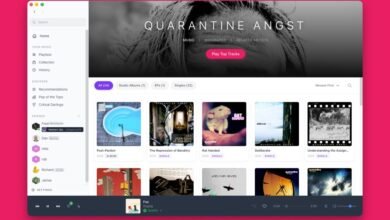

For device makers, complying with Netflix’s terms is essentially non-negotiable. The service accounts for a staggering 19 percent of all streaming traffic in North America, making its app a critical feature for any competitive television or streaming device. The certification process, often labeled “Netflix Ready,” involves a detailed set of technical mandates covering DRM and codecs. Beyond performance, the rules enforce Netflix’s market dominance. Manufacturers must include a physical Netflix button on their remotes, with Apple being a notable exception, and guarantee the app is the first icon on the home screen’s primary app row.

The influence extends into data and content discovery. Netflix tightly controls the information it shares with smart TV platforms, limiting how operating systems can use its catalog for recommendations. On a Google TV interface, for instance, you’ll find rows suggesting comedies or award-winning films, but these will never include Netflix originals. Ask an Amazon Fire TV voice remote to find a Netflix show, and it simply opens the app rather than displaying a detail page with cross-service suggestions. Similarly, Roku users cannot add Netflix titles to their universal watchlist, a feature available for HBO Max and Disney+ content.

Financial agreements further distinguish Netflix from other streamers. Platforms like Roku have publicly stated that Netflix does not share subscriber revenue, unlike many other services. Netflix has also avoided participation in third-party “channel stores,” such as those operated by Amazon, where services like HBO Max are resold.

The pending acquisition of Warner Bros. introduces significant uncertainty. Netflix has described HBO Max as “complementary” and plans to maintain its operations initially. However, industry experts widely anticipate a longer-term technical integration, potentially folding HBO Max into the Netflix app as a dedicated hub, mirroring Disney’s approach with Hulu. This consolidation could amplify Netflix’s leverage in device negotiations, possibly leading to even stricter placement rules for HBO content on home screens.

A major wild card is the regulatory review facing the deal. Approval is required not only in the United States but likely from competition authorities in the UK and European Union. This scrutiny could pressure Netflix to relax some of its restrictive policies, potentially opening its walled garden. The outcome might eventually allow features consumers have long been denied, such as adding a Netflix series to a television’s universal watchlist. The future of your remote control and home screen may hinge on how these negotiations between corporate strategy and regulatory oversight ultimately unfold.

(Source: The Verge)