Robinhood Launches Copy Trading After Warning Rivals on Regulation

▼ Summary

– Robinhood is launching “Robinhood Social,” a copy trading feature allowing users to manually replicate trades of prominent investors, marking a significant shift from its historically cautious regulatory stance.

– The company previously expressed concerns about copy trading attracting regulatory scrutiny, with its CEO suggesting smaller platforms like Dub operated under less oversight.

– Robinhood’s entry into copy trading suggests it believes the regulatory environment has changed sufficiently, possibly influenced by evolving policies under different administrations.

– The platform differs from competitors by requiring manual trade replication instead of automatic copying, a design choice that may help address regulatory concerns.

– This move could signal broader acceptance of copy trading in the U.S. and potentially open the floodgates for other fintech companies to enter the market.

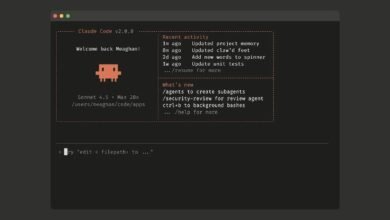

The shifting regulatory tides have prompted a significant strategic pivot from Robinhood, which is now launching its own copy trading service called Robinhood Social. This new feature enables users to manually follow and replicate the trades of well-known investors, marking a notable departure from the company’s earlier caution around practices that might attract regulatory attention.

Just nine months ago, Robinhood’s CEO Vlad Tenev suggested that emerging copy trading platforms were operating largely because they remained under the radar of watchdogs. Now, the brokerage appears confident that the environment has evolved enough to support its entry into this space. This reversal is especially striking given Robinhood’s history of sidestepping features perceived as gamified, like its infamous confetti animation, which was removed ahead of its IPO.

The announcement also highlights the growing competition within the social trading arena. Earlier this year, Steven Wang, the 23-year-old founder of rival platform Dub, criticized Robinhood for making trading accessible without sufficient educational safeguards, describing it as akin to “gambling for the broader population.” Wang has positioned Dub as a more responsible alternative, incorporating risk metrics and stability indicators to help users make informed decisions.

Despite speculation, a Robinhood representative confirmed that the new offering is not the result of an acquisition but an in-house development. The platform distinguishes itself by requiring manual trade replication rather than automatic copying, a design choice that may help alleviate regulatory concerns. It will feature verified traders, including prominent investors and even members of Congress, with an initial rollout planned for 10,000 test users early next year.

This move arrives amid broader changes in how financial regulators approach copy trading and digital assets. While Europe has long embraced social trading, U.S. adoption has been slow due to compliance hurdles. Recent developments, including a more favorable stance toward crypto under the Trump administration and successful public listings by firms like eToro, suggest the market may be opening up.

If Robinhood can navigate these legal complexities successfully, it may pave the way for other fintech companies to introduce similar services. The success of eToro’s recent IPO, which saw strong investor demand, underscores the growing appeal of social investing platforms. Whether this trend ultimately benefits everyday investors or simply drives up valuations in the sector remains an open question. For now, Robinhood’s shareholders appear to be the most immediate beneficiaries.

(Source: TechCrunch)