Sequoia Backs $1.5B Tender Offer for Sales Startup Clay

▼ Summary

– Kareem Amin, CEO of Clay, led the company through seven years of hard work before it saw explosive growth in 2022, reaching a $1B+ valuation and expanding to over 200 employees.

– Clay is allowing employees with at least one year of tenure to sell shares at a $1.5B valuation to Sequoia, offering liquidity and financial benefits to early team members.

– The company also enabled its community of customers to invest in Clay at the same valuation as Series B investors, raising $3M in a community round.

– Amin views the employee tender offer and community round as ways to share the company’s success collectively, rather than concentrating gains among a few stakeholders.

– Sequoia sees the tender as a chance to increase its stake in Clay, though demand may fall short of the $20M cap due to employees’ optimism about future share value.

Clay, the fast-growing sales automation platform, has secured a $1.5 billion valuation through a unique employee tender offer backed by Sequoia Capital. The deal allows eligible staff to sell a portion of their equity at favorable terms, marking a significant milestone for the seven-year-old startup.

Since its breakthrough in 2022, Clay has rapidly expanded, growing from a small team to over 200 employees while attracting major clients like OpenAI, HubSpot, and Canva. The company’s AI-powered tools help sales and marketing teams streamline data discovery and automate go-to-market strategies. Now, employees with at least one year of tenure can participate in the tender, potentially cashing out shares worth roughly a year’s salary.

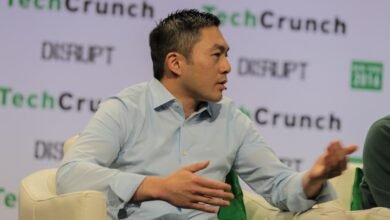

Sequoia, an early investor since 2019, is committing up to $20 million to purchase employee stock, reinforcing its confidence in Clay’s trajectory. The tender offer values the company higher than its January Series B round, which pegged it at $1.25 billion. CEO Kareem Amin emphasized that the move rewards employees who took a risk joining a startup, acknowledging that “most startups don’t work out—but Clay is.”

Beyond internal stakeholders, Clay has also empowered its customer base to invest in its growth. Earlier this year, the company raised $3 million in a community round, allowing direct users to buy in at the same valuation as Series B investors. Amin sees these initiatives as a way to distribute success more broadly, ensuring “the gains don’t just accumulate to a few people.”

While employees now have liquidity options, many may hold onto their shares, anticipating greater future value. Sequoia partner Alfred Lin noted that demand might fall short of the $20 million cap, joking that it’s “sad for Sequoia because we’d like to buy more.” With Clay’s rapid expansion, Amin plans to make tender offers an annual event, setting a potential precedent for other startups to follow.

Neither Amin nor co-founder Varun Anand plan to sell their shares in this round, signaling their long-term commitment. For Sequoia, the tender represents a strategic opportunity to deepen its stake in a company it believes has even more room to grow. As Clay continues scaling, its innovative approach to employee and customer engagement could redefine how startups share success.

(Source: TechCrunch)