10 Gigabit Broadband: Utility in Singapore, Luxury in US

▼ Summary

– Singapore offers 10 gigabit fiber as a mainstream service to most households, while in the US it remains a premium product for a small market share.

– Singaporean consumers pay as little as $22 per month for 10 gigabit service, whereas comparable US offerings can cost up to $195 per month.

– Singapore’s wholesale open-access model, established in 2008, fosters intense retail competition by separating network ownership from retail operations.

– In the US, vertically integrated operators limit competition in most local markets, allowing providers to position multi-gigabit service as a premium tier.

– Market design and policy, not technology, are the primary drivers of broadband affordability and adoption, shaping digital inclusion and competitiveness.

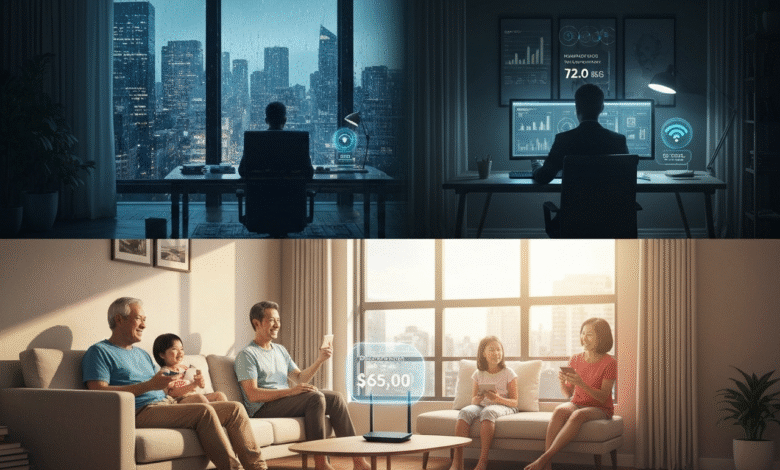

A recent analysis from global telecom data provider Tarifica highlights a dramatic difference in how ultra-high-speed broadband is viewed and priced in Singapore compared to the United States. In Singapore, 10 gigabit fiber internet has become a standard utility accessible to the majority of households. Meanwhile, across the U.S., the same level of service is marketed as a high-end luxury, available to only a small segment of the market.

The cost disparity is significant. Singaporean consumers can subscribe to a 10 gigabit plan for as low as $22 per month, whereas American customers may pay up to $195 monthly for a comparable, or sometimes slower, service. Many households in the U.S. end up paying several times more for internet speeds that are only a fraction of what’s available in Singapore. This gap isn’t due to differences in technology, as both nations rely on similar fiber-optic infrastructure. Instead, it reflects fundamental differences in market structure and regulation.

Singapore’s approach, established through government policy in 2008, is built around a wholesale open-access model. This framework separates the ownership of the physical network from the retail service providers. Every internet company leases capacity from the same underlying fiber network under identical terms. The result is a highly competitive retail environment where providers must distinguish themselves through pricing, service quality, and customer support.

Soichi Nakajima, Vice President of Data and Analysis at Tarifica and the study’s author, observed, “In Singapore, the impact of this structure is clear. Multiple ISPs compete intensely, prices adjust rapidly, and extremely high speeds are considered the norm for households. Ten gigabit broadband is no longer a status symbol, it’s a standard utility.”

The situation in the United States stands in sharp contrast. Most local markets are served by vertically integrated operators that control both the infrastructure and the retail customer relationships. With many households having only one or two choices for fixed-line internet, competition is limited. This allows providers to position multi-gigabit services as premium offerings rather than standard packages.

Tarifica’s research shows that Singapore’s major providers, SIMBA, M1, StarHub, and Singtel, offer 10 gigabit plans priced between $22 and $65 per month. In the U.S., similar or slower service tiers range from $100 to $195. As a result, American consumers often pay four to seven times more per gigabit than their counterparts in Singapore. Even in densely populated U.S. cities where infrastructure costs are similar, prices remain substantially higher, pointing to market dynamics rather than geography as the main factor.

Nakajima emphasized, “The essential point is that both countries use the same fiber technology. The different outcomes stem from differing market rules. Singapore’s model encourages direct retail competition, which drives prices down. The U.S. system permits limited competition and supports premium pricing. Technology defines what’s possible, but competition and policy determine the final cost.”

Looking forward, broadband affordability is expected to play an increasingly important role in digital inclusion and national competitiveness. Demand for bandwidth continues to grow with the expansion of artificial intelligence, cloud services, and immersive applications. In regions where very high speeds are affordable, both consumers and businesses can adopt new technologies more quickly. Where prices remain high, adoption slows and the advantages are largely confined to higher-income groups.

Singapore’s experience demonstrates that a wholesale open-access framework can make next-generation connectivity widely available. The U.S. experience shows that in markets with limited competition, ultra-fast broadband remains a niche product rather than a mass-market standard.

The central takeaway from Tarifica’s analysis is that market design, not just technology, determines who benefits from innovation and how quickly. As global connectivity demands increase, the decision to treat broadband as a basic utility or as a premium luxury will shape who can participate fully in the expanding digital economy.

Tarifica’s latest Data Dive draws from its Telecom Pricing Intelligence Platform (TPIP), which provides comprehensive data on service plans from major operators worldwide. The platform allows users to build customized profiles for detailed comparisons and analysis. Subscribers can explore trends and visualize data using intuitive tools and multiple filters for a granular perspective. Modern features such as screenshot capture, alerts, and access to historical offers help users move beyond traditional Excel-based limitations. TPIP is designed to be flexible, enabling customization of data structure, geographic scope, and update frequency to meet specific client requirements.

Tarifica is a recognized leader in supplying telecom data and software solutions to the global telecommunications industry. Specializing in telecommunications plan and pricing intelligence, the company delivers essential insights and analytics that help telecom operators, regulators, and other stakeholders make informed, data-driven decisions. Its client base includes national regulatory bodies, mobile and fixed-line operators, internet service providers, consulting firms, and financial institutions around the world. In addition to its flagship software-as-a-service products, Tarifica offers specialized consulting services tailored to individual client needs. The company’s dedication to innovation and quality has established it as a trusted partner in the fast-changing telecom sector.

(Source: MEA Tech Watch)