Jeff Bezos: AI Bubble Is Real, But Benefits Will Be ‘Gigantic’

▼ Summary

– Jeff Bezos and Sam Altman both acknowledge an AI bubble exists, with Bezos seeing it as having positive potential.

– Bezos distinguishes this as an “industrial bubble” rather than a financial one, which he believes is less harmful and can benefit society.

– He compares the AI bubble to the 1990s biotech bubble, which led to life-saving drugs despite many companies failing and significant financial losses.

– During bubbles, investors fund both good and bad ideas, making it hard to distinguish them, which Bezos notes is happening with AI today.

– Bezos emphasizes that AI’s transformative potential is real and will change every industry, regardless of the bubble’s existence.

The current surge in artificial intelligence investment has sparked widespread debate about a potential market bubble, with Jeff Bezos recently acknowledging this reality while expressing profound optimism about the technology’s long-term impact. Amazon’s visionary founder joined OpenAI CEO Sam Altman in recognizing the speculative frenzy surrounding AI companies, yet both leaders emphasize the substantial societal gains that will ultimately emerge from this technological revolution.

Sam Altman previously characterized the AI market’s exuberance as a natural response to genuine breakthroughs, comparing it to the internet’s early days when excitement sometimes outpaced practical application. He suggested that while intelligent people often become overly enthusiastic about a promising new field, the economic benefits from artificial intelligence will likely prove enormous in the long run.

Bezos has now echoed this perspective with even greater conviction about AI’s positive trajectory. He distinguishes between different types of market bubbles, categorizing the current AI phenomenon as an “industrial bubble” rather than a purely financial one. This crucial difference, he argues, should reassure investors concerned about historical parallels with the dot-com crash.

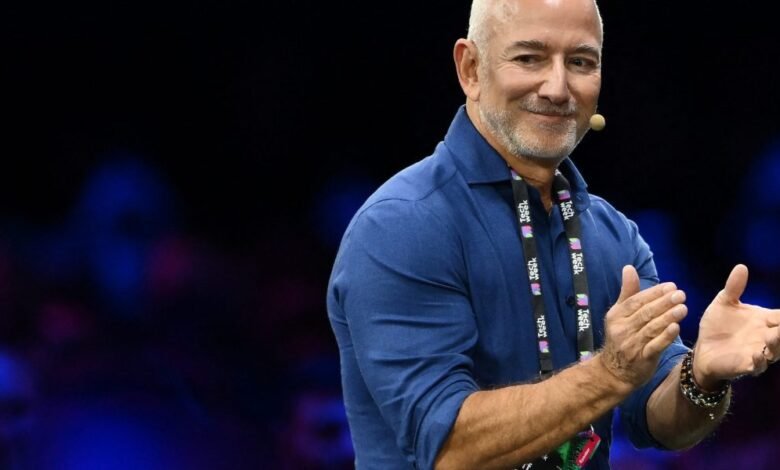

Industrial bubbles frequently produce valuable outcomes despite the inevitable shakeouts, Bezos explained during his appearance at Italian Tech Week. He pointed to the biotechnology sector’s experience in the 1990s, where massive investment eventually yielded breakthrough medications that saved countless lives, even though many individual companies failed during the process. The Wall Street Journal documented that public biotech firms collectively lost over $40 billion during that period, yet society ultimately benefited tremendously from the surviving innovations.

According to Bezos, these development cycles create significant value once the initial excitement subsides and true industry leaders emerge. “When the dust settles and you see who are the winners, societies benefit from those investors,” he observed. “That is what is going to happen here too. This is real, the benefits to society from AI are going to be gigantic.”

The Amazon founder noted that bubble periods typically feature abundant capital flowing into both promising and questionable ventures, as investors struggle to separate viable projects from impractical ones. He believes this pattern is repeating itself within the AI sector today, with funding reaching numerous startups regardless of their actual potential.

Meta’s chief executive Mark Zuckerberg has voiced similar sentiments, acknowledging the possibility of an AI bubble while emphasizing his company’s commitment to the technology. Zuckerberg stated he would prefer to overspend by hundreds of billions rather than risk missing the advent of artificial superintelligence.

Bezos remains unequivocal about artificial intelligence’s fundamental importance, regardless of market cycles. The speculative environment doesn’t diminish AI’s transformative potential or its capacity to revolutionize every industry, he stressed. The underlying technology represents a genuine paradigm shift that will reshape business and society in ways we’re only beginning to comprehend.

(Source: Fortune)