Silver’s Quiet Upgrade: AI, Tech and a Path to $90 by 2030

▼ Summary

– Silver’s role has shifted from defensive to strategic due to rising demand from AI hardware, clean energy, and advanced electronics.

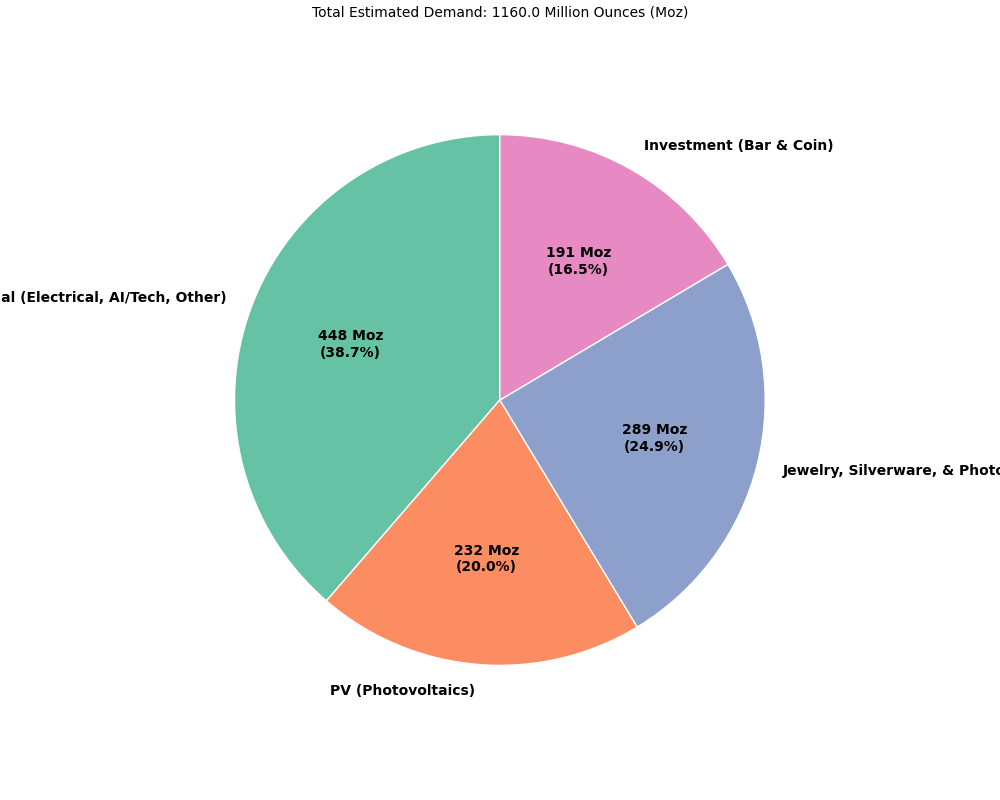

– Industrial demand reached a record 680.5 million ounces in 2024, creating a structural market deficit of 148.9 million ounces.

– AI and tech sectors drive demand through components, data infrastructure, and clean energy applications, while ETFs and physical purchases amplify price movements.

– Price forecasts project gradual annual increases, with base scenarios reaching $91 by 2030, influenced by industrial growth and investment flows.

– Investors are advised to consider tactical allocations via ETFs or bullion, with risk controls and regular monitoring of market data.

Silver is stepping into a new spotlight. Once seen as gold’s cheaper sibling, it is now being reshaped by demand from AI hardware, clean energy and advanced electronics. For professionals watching semiconductors, data infrastructure and renewables, silver’s role has shifted from mainly defensive to increasingly strategic.

Recent context and the data that matter

- 2022: ≈ $24–26/oz – macro headwinds (strong dollar, higher real rates).

- 2023: ≈ $24–28/oz – early supply pressures emerge.

- 2024: ≈ $29 (average) with spikes above $30. Industrial demand reached a record 680.5 million ounces in 2024. (The Silver Institute)

- 2025 (YTD): strong momentum – silver is up materially year-to-date amid ETF interest and tech-driven consumption. (Sprott)

The World Silver Survey shows a structural market deficit of 148.9 million ounces in 2024, evidence that demand is outpacing supply in several end-use markets. (The Silver Institute)

Why AI and tech push the case

AI and next-gen electronics raise silver’s industrial intensity in three ways:

- Component-level demand: silver is widely used in connectors, contacts and printed circuitry where low resistance and reliability matter — features central to GPUs, AI accelerators and edge devices.

- Infrastructure scaling: data centers, optical interconnects and power distribution for AI workloads require high-performance contacts and sensors that often use silver.

- Clean-energy overlap: PV panels, EV chargers and grid upgrades all add silver demand; thrift per-unit is real, but scale offsets it. (The Silver Institute)

At the same time, ETFs and bar/coin purchases absorb physical metal, pulling some supply out of the industrial loop and amplifying price moves. Recent 2025 inflows into silver-backed funds have been notable. (Kitco)

Forecast (transparent assumptions) and investor playbook

Key assumptions behind the numbers: baseline industrial demand growth ~4% CAGR (AI, PV, electrification), modest recycling gains, primary mine output growth ~1% annually, continued positive net ETF demand in the near term, and a macro backdrop where real yields ease modestly through 2026–27.

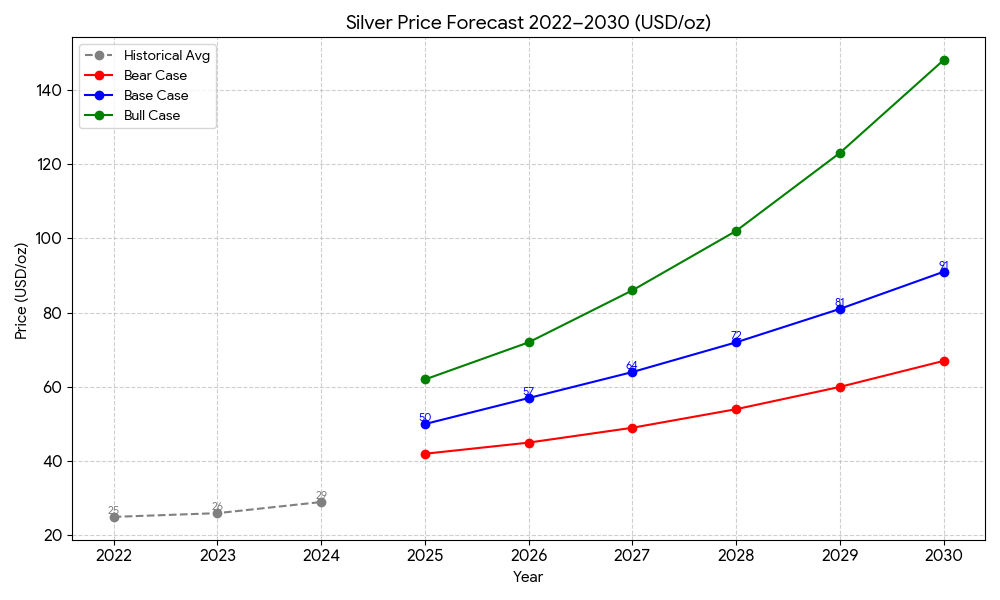

Historical (2022–2024) precedes the forecasts. Below are year-end price paths (USD/oz) under three scenarios.

| Year | Bear | Base | Bull |

|---|---|---|---|

| 2025 | $42 | $50 | $62 |

| 2026 | $45 | $57 | $72 |

| 2027 | $49 | $64 | $86 |

| 2028 | $54 | $72 | $102 |

| 2029 | $60 | $81 | $123 |

| 2030 | $67 | $91 | $148 |

The Base path is the headline projection (a gradual 10–14% annual rise after 2025). The Bull path assumes faster industrial adoption and stronger ETF hoarding; the Bear path assumes faster rate hikes, meaningful substitution in some applications, or big recycling gains.

Practical steps for different readers

- Tech professionals / allocators: consider a modest tactical allocation (1–5% of liquid portfolios) via physically backed ETFs or allocated bullion if you prioritise liquidity. For longer horizon exposure, combine physical with a small allocation to high-quality mining and royalty stocks.

- Retail/common investors: prefer small, regular buys into bullion or ETFs rather than trying to time peaks; expect volatility.

- Risk controls: set position caps, watch ETF flows monthly, and revisit assumptions annually (recycling, mine projects, substitution in PV/electronics). Relevant data sources: Silver Institute World Silver Survey, ETF fact sheets, Sprott analysis. (The Silver Institute)