Europe’s Battery Goals in Peril After Northvolt’s Downfall

▼ Summary

– Northvolt, once a promising European battery manufacturer with $15bn in financing, has declared bankruptcy after job cuts, restructuring, and failed funding efforts.

– The bankruptcy has highlighted issues such as intense competition, overspending, mismanagement, and lack of state support, but the drive for a strong European battery sector persists.

– Europe faces significant challenges in building a resilient battery value chain, with formidable competition from Asia being a major obstacle.

– Chinese and South Korean firms dominate the European battery market, with notable partnerships like Gotion with Volkswagen and CATL with Stellantis, while Northvolt struggled.

– Strategic investments by Asian companies in European startups, such as Gotion’s stake in InoBat, demonstrate successful collaboration, which is seen as crucial for the future of Europe’s battery industry.

Fuelled by $15bn in financing, Northvolt was touted as Europe’s beacon in the battery industry,an indigenous powerhouse poised to rival the Asian and American giants. The company’s recent bankruptcy, after enduring months of job cuts, restructuring, and unsuccessful funding endeavors, has struck a significant blow to Europe’s goal of establishing a robust domestic lithium-ion battery production ecosystem.

The downfall of Northvolt has sparked a flurry of analysis from politicians, investors, and employees. The reasons cited range from intense competition and overspending to allegations of mismanagement and insufficient state support. Despite the setback, the consensus among tech investors and startups is that the pursuit of a strong European battery sector must continue.

Creating a resilient battery value chain in Europe, however, is fraught with challenges. Chief among them is the formidable competition from Asia, which may prove insurmountable. Currently, Europe faces two distinct paths: collaborating with established Asian battery giants or pioneering advancements in next-generation battery technologies.

Chinese Influence and Strategic Partnerships

Northvolt’s ambition to capture 25% of Europe’s battery market by 2030 was overly optimistic, especially given the strong foothold of Chinese and South Korean firms, which supplied 90% of Europe’s batteries last year. While Northvolt struggled, Chinese companies secured significant deals with European automakers. Gotion’s partnership with Volkswagen and CATL’s joint venture with Stellantis to build a €4.1bn lithium battery factory in Spain are notable examples of this trend.

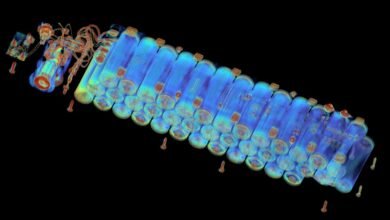

Asian battery manufacturers are also making strategic investments in European startups. Gotion’s 25% stake in Slovakia’s InoBat, a startup that has raised $400mn to date, exemplifies this approach. The partnership has enabled InoBat to leverage Gotion’s extensive expertise, avoiding pitfalls that befell Northvolt. Together, they are set to build a €1.2bn lithium-ion battery plant in Slovakia by 2027, aimed at powering EVs and electric aircraft.

InoBat is also constructing a smaller gigafactory to produce batteries for high-performance EVs, with testing underway for European automakers, including Ferrari. Similarly, British solid-state battery firm Ilika is capitalizing on China’s battery industry prowess. Ilika’s CEO, Graeme Purdy, highlighted the lack of “Asian partnerships” as a possible factor in Northvolt’s downfall, emphasizing that global cooperation is crucial for commercial success.

Europe’s battery aspirations are at a critical juncture. The continent must decide whether to align more closely with Asian battery leaders or to invest heavily in pioneering new battery technologies. The road ahead is challenging, but the pursuit of a sustainable and competitive battery industry in Europe continues to be of paramount importance.

Source: The Next Web