The $100M+ Fusion Startups: Who’s Leading the Charge?

▼ Summary

– Fusion power has evolved from a distant promise to a tangible technology, attracting significant investment due to recent scientific and engineering advances.

– Key drivers include powerful computer chips, sophisticated AI, and high-temperature superconducting magnets, enabling better reactor designs and simulations.

– A major milestone was achieved in 2022 when a U.S. lab produced a controlled fusion reaction exceeding scientific breakeven, validating the underlying science.

– Leading companies like Commonwealth Fusion Systems, Helion, and TAE are developing diverse reactor designs with aggressive timelines for commercial power generation.

– Private funding has surged, with startups raising billions from investors, though challenges remain in achieving commercial viability and scaling up.

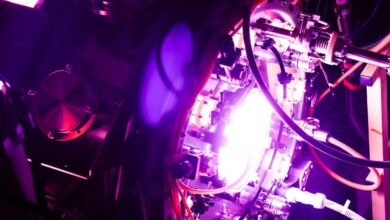

Fusion energy has transformed from a distant scientific dream into a serious pursuit attracting major capital and top engineering talent. Private investment in fusion startups now exceeds $10 billion, driven by breakthroughs in computing, materials science, and sustained plasma confinement. What was once considered perpetually decades away is now the focus of well-funded ventures racing toward commercialization.

Recent progress stems from three critical technological advances: more powerful computing hardware, sophisticated artificial intelligence applications, and the development of high-temperature superconducting magnets. These innovations have enabled more refined reactor designs, highly accurate plasma simulations, and advanced control systems capable of managing extreme conditions.

A pivotal moment arrived in late 2022 when a U.S. Department of Energy laboratory announced it had achieved a controlled fusion reaction that produced more energy than the lasers delivered to the fuel. This milestone, known as scientific breakeven, validated the core physics and energized both public and private sectors. While commercial viability, where the entire facility produces net energy, remains challenging, the achievement marked a turning point in credibility and investor confidence.

Commonwealth Fusion Systems leads the pack in funding, having raised nearly $3 billion to date. Their Sparc reactor, a compact tokamak design using revolutionary high-temperature superconducting magnets developed with MIT, aims to achieve commercially relevant power output by late 2026. Following Sparc, the company plans to construct Arc, a full-scale power plant in Virginia capable of generating 400 megawatts, with Google already committed to purchasing half its output.

TAE Technologies, operating since 1998, employs a unique field-reversed configuration method. Their approach involves colliding plasma streams and maintaining stability using particle beams, extending plasma longevity to improve energy extraction. The company has secured $1.79 billion in funding, with continued support from investors like Google and Chevron.

Helion stands out with its aggressive timeline, targeting electricity generation by 2028. Microsoft has signed as its first customer. Helion’s reactor accelerates plasma rings to over a million miles per hour before colliding them, inducing fusion and directly capturing electrical current from the resulting magnetic fields. The company has raised over $1 billion from prominent backers including Sam Altman and Peter Thiel.

Newcomer Pacific Fusion launched with a staggering $900 million Series A round. Their approach uses coordinated electromagnetic pulses rather than lasers to compress fusion fuel, relying on precisely timed impulses from an array of generators. Funding is structured around milestone achievements, a model more common in biotechnology than energy tech.

Some companies are pursuing intermediate revenue streams. Shine Technologies focuses on neutron testing and medical isotopes while developing capabilities for future power generation. They’ve raised $778 million by leveraging fusion technology for near-term industrial and medical applications rather than waiting for full-scale energy production.

General Fusion, now in its third decade, continues developing magnetized target fusion using pistons to compress liquid metal-lined chambers. Despite recent financial challenges and staff reductions, the company secured a $22 million lifeline to continue work on its LM26 device aimed at reaching breakeven.

Tokamak Energy is refining spherical tokamak designs that reduce size and magnet requirements. Their compact reactors use high-temperature superconductors to contain plasma at extreme temperatures. The U.K.-based company has raised $336 million and is constructing its next-generation Demo 4 device to test magnet performance under power plant conditions.

Zap Energy employs a radically different approach, using electrical currents to self-generate magnetic fields that compress plasma to fusion conditions. This eliminates need for complex laser or magnet systems. Backed by Bill Gates and others, the company has raised $327 million to develop its simplified reactor design.

Several newer entrants are exploring alternative concepts. Proxima Fusion attracted €185 million to advance stellarator technology, which uses twisted magnetic fields to better contain unstable plasma. Marvel Fusion is leveraging semiconductor manufacturing techniques to produce laser targets for inertial confinement fusion, with a demonstration facility planned for 2027.

Not every venture survives the transition to commercialization. First Light recently pivoted from developing fusion power to supplying technology to other companies, highlighting the sector’s technical and financial challenges.

Xcimer Energy emerged with $109 million in funding to scale up laser-based fusion technology. Their design builds upon the National Ignition Facility’s success but uses more powerful lasers and innovative molten salt shielding to manage energy extraction and component durability.

The fusion landscape continues evolving rapidly, with scientific progress and investment milestones arriving at an accelerating pace. While significant engineering hurdles remain, the combination of technological advances and substantial private investment suggests that commercial fusion power may be closer than ever before.

(Source: TechCrunch)