Small Nuclear Reactors: Startups’ Big Comeback and Challenges

▼ Summary

– The nuclear industry is experiencing a resurgence, with startups raising significant capital based on optimism for smaller, modular reactors.

– Traditional large-scale reactors, like the recent U.S. projects, have faced major delays and cost overruns, which new startups aim to avoid.

– These startups believe smaller reactors can be mass-produced, allowing for scalable power and potential cost reductions through manufacturing improvements.

– However, a critical challenge is the U.S.’s eroded manufacturing expertise and supply chain, lacking both materials and skilled personnel for industrial-scale production.

– Achieving the promised cost benefits of mass manufacturing will require a modular, iterative approach and is expected to take years, not happen immediately.

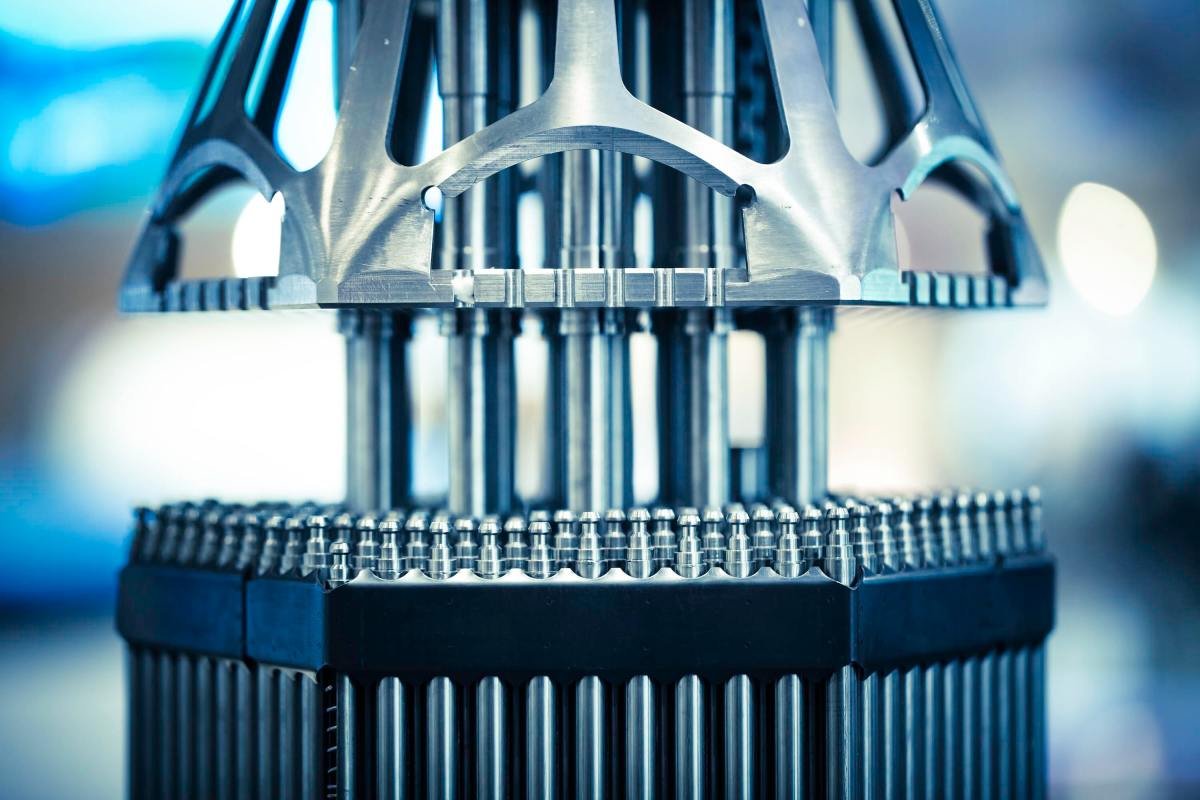

A significant resurgence is underway within the nuclear energy sector, fueled by substantial investment and a strategic pivot toward innovative reactor designs. Small modular reactors (SMRs) represent the core of this movement, with startups securing over a billion dollars in recent funding on the promise that downsizing and modularization can solve the industry’s historical challenges of massive cost overruns and lengthy construction delays. Unlike traditional behemoths like the Vogtle plant reactors, which required tens of thousands of tons of concrete and faced severe budget and timeline issues, these new ventures propose a different path. Their vision involves factory-built, standardized units that can be deployed incrementally, theoretically leveraging manufacturing efficiencies to reduce expenses over time.

The central thesis is compelling: build reactors smaller, produce them in volume, and let economies of scale and learning curves drive down costs. The potential benefit is clear, though its exact magnitude remains a subject of ongoing study. For these ambitious companies, the entire business case hinges on this principle delivering tangible results. However, transitioning from a project-based construction industry to a streamlined manufacturing operation presents a formidable set of real-world obstacles.

Manufacturing at scale is notoriously difficult, even for industries with deep domestic expertise. Observers often point to Tesla’s well-documented struggles in profitably ramping up production of the Model 3. The automotive sector, however, still possesses a significant U.S. industrial base, an advantage the modern nuclear supply chain sorely lacks. According to investor Milo Werner, a general partner at DCVC, the country has lost critical capabilities. “I have a number of friends who work in supply chain for nuclear, and they can rattle off like five to ten materials that we just don’t make in the United States,” she noted. “We have to buy them overseas. We’ve forgotten how to make them.”

Werner’s perspective is informed by hands-on experience in high-volume production, having led new product introductions at Tesla and Fitbit before moving into venture capital. She identifies two primary hurdles for any company looking to manufacture: capital and human capital. For the nuclear industry, the first is currently less concerning. “They’re awash in capital right now,” she stated. The far more pressing issue is the severe shortage of skilled personnel.

Decades of offshoring have eroded the nation’s industrial knowledge base. “We haven’t really built any industrial facilities in 40 years in the United States,” Werner explained. This has led to a collective loss of practical experience, which she likens to attempting to run a marathon after a decade of inactivity. The deficit isn’t limited to machine operators; it extends across the entire organizational chart, from factory floor supervisors to financial executives and board members with relevant operational insight.

Despite these challenges, a positive trend is emerging. Werner sees many startups, including those in nuclear, choosing to develop early-stage prototypes close to their engineering teams. This co-location fosters a faster cycle of testing and refinement, effectively pulling initial manufacturing steps back to the U.S. and building foundational knowledge. For investors, this approach is crucial. Embracing modularity from the outset allows companies to begin production in small batches, generating valuable process data that demonstrates improvement and de-risks the scaling journey.

It is vital to maintain realistic expectations about the timeline for achieving manufacturing efficiencies. The projected cost reductions from learning and scale are not instantaneous. Companies may forecast optimistic curves, but the reality often requires sustained effort. “Often it takes years, like a decade, to get there,” Werner cautioned. The path for nuclear startups is therefore a long-term commitment, balancing bold technological innovation with the painstaking work of rebuilding a sophisticated industrial ecosystem from the ground up.

(Source: TechCrunch)