▼ Summary

– Tide has become a unicorn with a $120 million funding round led by TPG, valuing the company at $1.5 billion.

– The fintech serves over 1.6 million micro and small enterprises globally, with India as its largest and fastest-growing market.

– Tide provides a unified business platform with tailored tools like accounting, invoicing, loans, and payroll for small businesses.

– The company expanded into India in 2022 and has already onboarded over 800,000 businesses there, aiming for one million by year-end.

– With the new funding, Tide plans to expand geographically, enhance its product, and invest in agentic AI.

Tide, a UK-based financial technology firm, has officially reached unicorn status following a substantial $120 million investment round led by global investment firm TPG. This milestone underscores the company’s rapid expansion, particularly within India, which now represents its largest and fastest-growing market. With more than 800,000 Indian small businesses already on board, Tide’s platform is reshaping how micro-enterprises and solo entrepreneurs manage their financial operations.

The funding injection, a combination of primary and secondary investments, places Tide’s valuation at an impressive $1.5 billion. While the company did not disclose the precise breakdown, the round involved share sales from employees, early-stage angels, and select minority investors. TPG participated through its impact-focused Rise Fund, which supports mission-aligned enterprises worldwide. Apax Digital Funds, an existing investor, also contributed to the round.

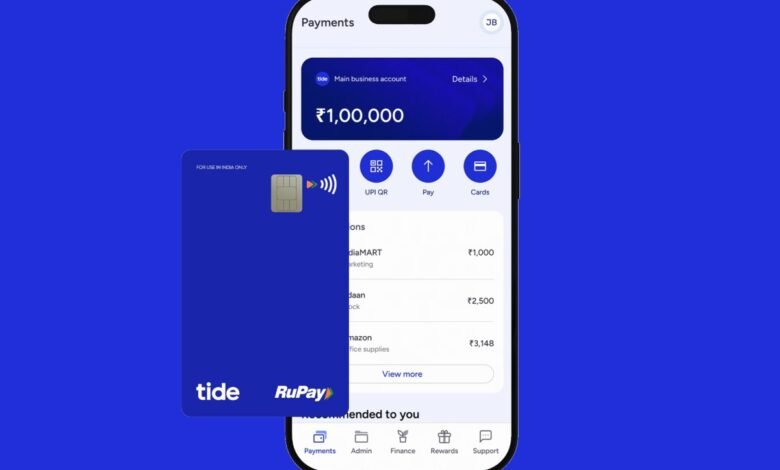

Around the world, small business owners, including freelancers, contractors, and independent operators, often struggle with time-consuming administrative duties like bookkeeping, tax compliance, loan applications, and payment processing. Although both conventional banks and modern fintech firms provide services to this segment, few deliver truly customized solutions. Tide addresses this gap through an integrated platform featuring tools such as invoicing, accounting software links, business lending, payroll services, corporate registration, and specialized expense cards.

Originally launched in the UK in 2017, Tide made a strategic move into India in late 2022, targeting the country’s enormous base of small and micro enterprises. Recent government estimates indicate India is home to approximately 60 million such businesses, employing more than 250 million individuals. In under two years, Tide has attracted over 800,000 Indian members, surpassing its UK membership of a similar size. Notably, the company is already profitable in the UK, where it serves about 14% of the small and medium business sector.

Oliver Prill, Tide’s CEO, emphasized that the primary challenge in markets like India isn’t competition from other fintech providers, but rather the pervasive use of cash. He noted that despite some moderation in growth rates, India continues to demonstrate remarkable expansion compared to European markets. The country sees nearly four million new small businesses launched annually, many of which require support with formal credit access, digital payment integration via UPI, and compliance with India’s Goods and Services Tax framework.

Tide serves these enterprises through a mobile application available on iOS and Android, offering a suite of tailored financial tools. The company collaborates with roughly 25 lending institutions in India to facilitate credit access, matching businesses with appropriate financial products based on individual needs. Additional services include fixed deposits, utility bill payments, fund transfers, and ATM cash withdrawals.

Gurjodhpal Singh, CEO of Tide India, reported strong uptake even in tier-3 cities and less urbanized regions, where digital infrastructure is still developing. The company aims to cross the one-million-member mark in India by year-end.

Beyond the UK and India, Tide has recently extended its footprint into Germany and France, adapting its offerings to include local language support and region-specific features. The new capital will support further geographic expansion, product innovation, and investment in agentic AI technologies.

While Tide already delivers a wide array of financial and administrative services, CEO Prill hinted at significant new product developments in the coming months, powered by this latest funding round. The company currently employs more than 2,500 people across its international operations.

(Source: TechCrunch)