Antares Raises $96M to Power Land, Sea, and Space with Microreactors

▼ Summary

– Antares, a nuclear startup, has raised $96 million in Series B funding to advance its small modular reactor design.

– Its R1 microreactor, which uses TRISO fuel, is designed to produce 100 kW to 1 MW of power for commercial, defense, and space applications.

– The company is part of a broader trend of renewed investment in nuclear power, with several other startups like X-energy and TerraPower also securing major funding.

– Large-scale nuclear plants are also seeing renewed activity, with companies like Constellation Energy and Amazon investing in restarting or purchasing power from existing facilities.

– Antares is a participant in a Department of Energy pilot program and aims to demonstrate its reactor in 2025, with a full-power reactor targeted for 2027.

The nuclear energy sector is witnessing a significant resurgence, with innovative startups securing substantial funding to develop next-generation power solutions. Antares, a company specializing in small modular reactor (SMR) technology, recently announced a $96 million Series B funding round. This investment, led by Shine Capital and supported by firms like Alt Capital and Caffeinated, includes $71 million in equity and $25 million in debt. The capital infusion will accelerate the development of Antares’s R1 microreactor, a compact unit designed to generate between 100 kilowatts and 1 megawatt of electricity for diverse applications on land, at sea, and in space.

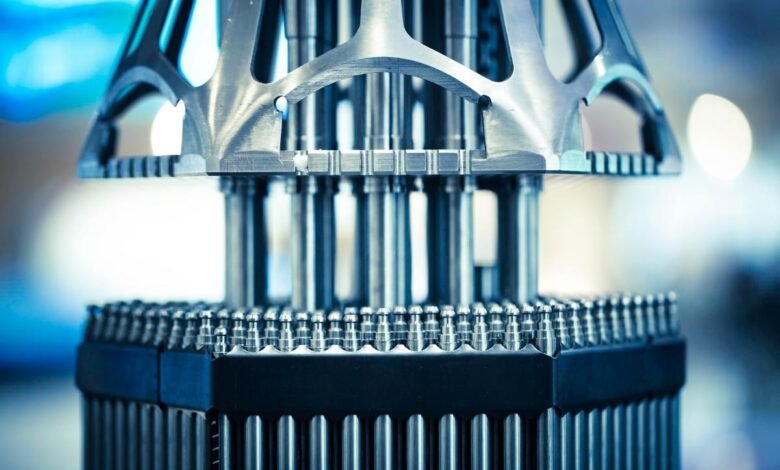

Antares is part of a broader wave of investment and interest in advanced nuclear technology. The company’s design utilizes TRISO fuel, a robust form of nuclear fuel consisting of uranium particles coated in carbon and ceramic, embedded within graphite. This fuel type is considered exceptionally safe and is a focal point for several next-generation reactor designs. The recent funding success for Antares mirrors momentum across the industry. Just last week, X-energy, another TRISO-focused developer backed by Amazon, closed a $700 million Series D round. Other notable deals include Aalo Atomics raising $100 million in August for a microreactor-powered data center and Nvidia contributing to a $650 million round for Bill Gates-backed TerraPower in June.

This revival is not confined to small modular reactors. Large-scale nuclear power plants are also experiencing renewed support and investment. Earlier this month, Constellation Energy, a partner of Microsoft, secured a $1 billion loan from the Department of Energy to restart a reactor at Three Mile Island by 2028. Major technology corporations are actively seeking nuclear power to meet clean energy goals. Amazon recently purchased 1.92 gigawatts of capacity from a Pennsylvania nuclear plant, while Meta agreed to buy clean energy attributes from a Constellation facility in Illinois. Google has also announced a partnership to help reopen a nuclear plant in Iowa.

The federal government is playing a crucial role in accelerating development, particularly for smaller reactor designs. In August, Antares was selected as one of eleven participants in the Department of Energy’s reactor pilot program. This initiative has an ambitious goal: to have at least three of these advanced reactors operational by July 4, 2026. For an industry known for lengthy development timelines, this represents a dramatically accelerated pace. Antares has stated it aims to demonstrate its reactor for the DOE next year, with plans to activate its full-power reactor system sometime in 2027. The convergence of private investment, corporate energy procurement, and government support is creating a powerful catalyst for innovation across the entire nuclear energy landscape.

(Source: TechCrunch)