Nuclear Startup Deep Fission Goes Public via SPAC

▼ Summary

– Deep Fission went public via a reverse merger, raising $30 million and pricing shares at $3 each.

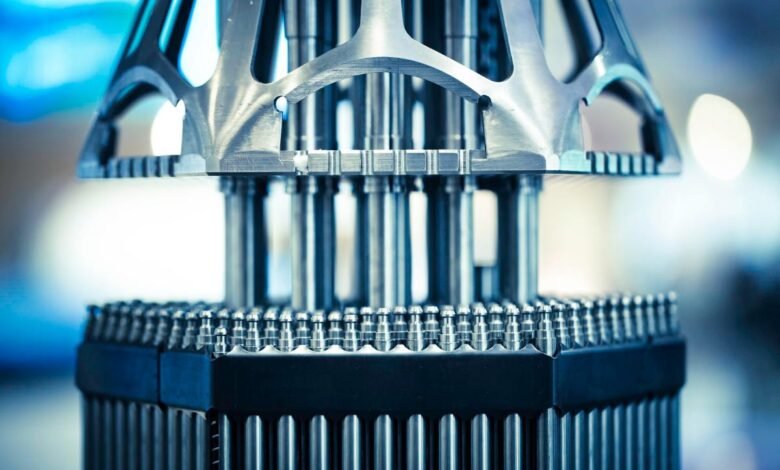

– The company plans to build small, cylindrical nuclear reactors buried one mile underground to address safety and security concerns.

– Its 15-megawatt reactors use pressurized water cooling, similar to nuclear submarines and existing power plants.

– Deep Fission signed a deal with Endeavor to develop 2 gigawatts of underground reactors and aims to start its first by July 2026.

– The startup was part of the Department of Energy’s Reactor Pilot Program and had previously attempted a $15 million seed round.

Nuclear energy startup Deep Fission has entered the public market through a reverse merger, securing $30 million in funding to advance its vision of deeply buried small-scale reactors. This move comes at a time when many startups are struggling to attract investment, highlighting both the persistent interest in advanced nuclear solutions and the challenging financial landscape for new entrants in the energy sector.

The company’s innovative approach involves constructing compact, cylindrical nuclear power units designed to be lowered a mile underground into precisely drilled 30-inch boreholes. By situating reactors deep beneath the surface, Deep Fission aims to address longstanding concerns associated with traditional nuclear facilities, including the risks of meltdowns and security threats. These 15-megawatt pressurized water reactors borrow proven technology from naval and existing power generation systems, offering a familiar yet novel application.

Earlier this year, Deep Fission formed a significant partnership with data center developer Endeavor, with plans to deploy up to 2 gigawatts of underground reactor capacity. This collaboration underscores the growing demand for reliable, high-density power sources, particularly from energy-intensive industries like data processing.

Just months ago, the company was seeking a $15 million seed round. Its fortunes shifted when it was selected, along with nine other nuclear fission startups, for the Department of Energy’s Reactor Pilot Program, which simplifies regulatory pathways for advanced nuclear projects.

The reverse merger was executed with Surfside Acquisition Inc., a special purpose acquisition company. Shares were priced at $3 each, notably lower than the typical $10 benchmark for SPAC offerings. The combined entity will operate under the Deep Fission name and intends to list on the OTCQB market, though trading has not yet commenced.

The structure and timing of this transaction imply that conventional equity fundraising may have proven difficult. Last year, initial backers provided $4 million in early-stage capital. While the merger extends the company’s financial runway, it also introduces new obligations, including SEC reporting requirements that could strain a small firm operating in a capital-intensive industry.

Deep Fission has set an ambitious target: to activate its first reactor by July 2026. Whether this timeline is achievable remains to be seen, but the company’s unconventional strategy reflects a bold attempt to redefine where and how nuclear energy is generated.

(Source: TechCrunch)