Europe’s Tech Boom: Unicorns and a New Identity Emerge

▼ Summary

– In early 2026, Europe’s startup ecosystem saw five new unicorns across diverse sectors like cybersecurity, cloud optimization, and defense tech.

– This activity signals Europe’s growing confidence and ability to produce world-class tech companies, moving beyond a historically cautious venture culture.

– The variety of sectors achieving high valuations shows European investment is becoming more selective, focusing on traction and regulatory demand rather than hype.

– Europe’s innovation benefits from strong regional expertise clusters and substantial institutional support, such as the EU’s Horizon Europe funding programme.

– The trend indicates a maturing European tech landscape defined by solving foundational problems with disciplined capital, not just by chasing high valuations.

The opening weeks of 2026 delivered a powerful statement from Europe’s technology sector, with five companies achieving unicorn status across a remarkably diverse range of industries. This surge in billion-dollar valuations for firms in cybersecurity, cloud optimization, defense technology, ESG software, and education technology signals a profound maturation of the continent’s innovation landscape. Far from a fleeting anomaly, this activity underscores a growing confidence that Europe can build and scale world-class technology companies on its own terms, developing a distinct identity separate from the dominant narratives of Silicon Valley.

This recent milestone adds to a significant foundation. By late 2025, Europe was already home to more than 217 unicorns. The latest entrants illustrate the ecosystem’s expanding breadth. Belgium’s Aikido Security secured a $1 billion valuation for its developer-focused cybersecurity platform. Lithuania’s Cast AI became the country’s fifth unicorn with technology that optimizes cloud infrastructure and AI workload costs. France’s Harmattan AI reached a $1.4 billion valuation for its defense software and autonomous systems. Germany’s Osapiens crossed the threshold by helping large enterprises manage ESG data and compliance. Ukraine-founded Preply achieved a $1.2 billion valuation for its global marketplace connecting learners with tutors.

The significance lies not merely in the number of new unicorns, but in their variety. The European story is no longer dominated by a single sector like generative AI. Instead, we see substantial investor backing for critical areas like cybersecurity, sustainability reporting, cloud efficiency, and specialized education. This diversity reflects a strategic shift in European venture capital, which is becoming more deliberate and outcome-oriented. Funding is increasingly directed toward companies demonstrating clear product-market fit, robust revenue models, and alignment with regulatory demands, rather than speculative trends.

This selective approach persists even amid broader market adjustments. While total venture capital investment in Europe has moderated from earlier peaks, the achievements in valuation and funding depth remain robust. This highlights a structural evolution: capital is flowing more thoughtfully toward ventures with defensible business models and tangible traction. The historical challenge of market fragmentation across languages and borders is increasingly viewed as a potential strength, fostering specialized clusters of expertise. Notable hubs are emerging for cybersecurity in Belgium, deep tech in the Nordics, cloud infrastructure in the Baltics, and edtech with connections to diverse European labor markets.

Institutional support from the European Union is providing a crucial backbone for this innovation. Programmes like Horizon Europe, with its massive budget dedicated to research and innovation, are strategically channeling resources into digital transformation, strategic autonomy, and industrial competitiveness. This public funding helps de-risk ambitious projects in areas such as advanced manufacturing, artificial intelligence, and green technologies. It creates a supportive environment where niche innovations, from advanced sensors to dual-use civil-defense applications, can align with broader continental strategic goals and find pathways to commercial success.

The emergence of these five unicorns feels like a phase transition rather than a fluke. It points to a sustainable upswing built on foundational strengths: solving real-world problems, leveraging domain-specific expertise, and operating within a framework where regulation can act as a catalyst for innovation. The European tech moment is not defined by headline-grabbing valuations alone. It is characterized by the practical breadth of problems being addressed and the disciplined conviction behind those solutions. The ecosystem’s path forward relies on continuing to scale this momentum into lasting growth and successful exits, proving that Europe’s unique formula of diverse innovation and strategic capital can compete on the global stage.

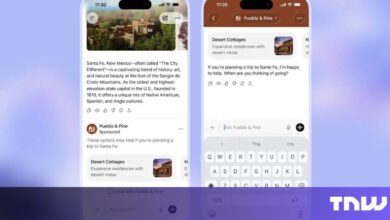

(Source: The Next Web)