OpenAI’s $38B Amazon Deal: A New AI Era Begins

▼ Summary

– OpenAI has signed a $38 billion multi-year deal with Amazon Web Services to purchase cloud infrastructure for training models and serving users.

– This deal highlights increasing industry entanglements, with OpenAI partnering with major tech firms like Amazon, Microsoft, Google, Oracle, Nvidia, and AMD.

– Concerns are rising about an AI bubble, with US companies projected to spend over $500 billion on AI infrastructure between 2026 and 2027.

– An analyst notes that OpenAI is diversifying its cloud providers to limit dependence, and Amazon is building custom infrastructure with advanced Nvidia chips for them.

– OpenAI is adopting a new for-profit structure to raise more capital, while remaining controlled by a nonprofit, to support scaling frontier AI.

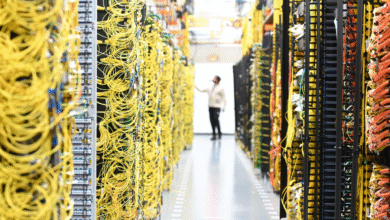

In a landmark move for the artificial intelligence sector, OpenAI has committed to a multi-year agreement with Amazon Web Services (AWS) valued at a staggering $38 billion. This massive investment secures critical cloud infrastructure essential for training sophisticated AI models and delivering services to a global user base. The partnership underscores the increasingly interconnected nature of the AI industry, placing OpenAI at the heart of significant alliances with major technology firms such as Google, Oracle, Nvidia, and AMD.

The AWS deal is particularly noteworthy given OpenAI’s historically close ties with Microsoft, Amazon’s primary competitor in the cloud computing arena. Further complicating the landscape, Amazon is a principal investor in Anthropic, a direct rival to OpenAI. Both Amazon and Microsoft are also aggressively developing their own proprietary AI models to challenge the dominance of innovative startups.

This relentless drive to amass computational power, coupled with the unconventional financial structures of these agreements, has sparked concerns about a potential AI bubble. According to financial journalist Derek Thompson, projections indicate that companies in the United States could collectively spend more than $500 billion on AI infrastructure between 2026 and 2027.

Patrick Moorhead, a leading analyst at Moor Insights & Strategy, offers a different perspective. He contends that major tech corporations and AI startups have a legitimate and pressing need for expanded capacity, viewing immense computing power as a direct pathway to profitability. Moorhead suggests this new deal effectively counters the narrative that Amazon is falling behind in the AI race. “Many people said they were down and out, but they just put $38 billion up on the board, which is pretty exceptional,” he observed.

He also highlighted OpenAI’s strategic objective to diversify its cloud provider dependencies. “OpenAI is deploying with pretty much everybody at this point,” Moorhead noted, indicating a deliberate effort to avoid over-reliance on a single partner.

Amazon’s official announcement detailed plans to construct custom infrastructure specifically for OpenAI. This specialized setup will leverage two advanced Nvidia chip architectures, the GB200 and GB300, engineered to handle both the training of new models and the inference processes for running them. The agreement guarantees OpenAI access to hundreds of thousands of state-of-the-art NVIDIA GPUs, with the potential to scale up to tens of millions of CPUs to manage rapidly growing “agentic” AI workloads.

OpenAI and other industry leaders are betting heavily on the future of agentic AI, anticipating its growing importance as users increasingly employ AI tools to perform complex tasks and navigate digital environments autonomously.

“Scaling frontier AI requires massive, reliable compute,” stated Sam Altman, co-founder and CEO of OpenAI, emphasizing the fundamental need for this level of infrastructure.

This strategic pivot coincides with OpenAI’s recent corporate restructuring. The company announced last week that it is adopting a new for-profit model designed to facilitate greater capital raising. While the overarching nonprofit entity retains control, its for-profit division has been reconstituted as a public-benefit corporation, signaling a new chapter in its financial and operational strategy.

(Source: Wired)