SoftBank Expands Robotics Empire with ABB Unit Acquisition

▼ Summary

– SoftBank Group is acquiring ABB Group’s robotics business for $5.375 billion, with the deal expected to close in mid-to-late 2026 pending regulatory approval.

– ABB’s robotics unit employs about 7,000 people and generated $2.3 billion in revenue in 2024, accounting for 7% of ABB’s total revenue.

– SoftBank aims to reignite sales at the robotics spinoff, whose 2024 revenue declined from $2.5 billion the previous year.

– CEO Masayoshi Son stated that SoftBank’s next frontier is “physical AI,” intending to combine AI and robotics to advance artificial super intelligence.

– Robotics is one of SoftBank’s four key focus areas, alongside AI chips, AI data centers, and energy, as part of its mission to drive the AI revolution.

In a major strategic expansion of its automation portfolio, SoftBank Group has finalized a $5.375 billion agreement to acquire the robotics division of Swiss engineering giant ABB. This landmark acquisition signals the Japanese investment conglomerate’s intensified focus on what it terms “physical AI,” positioning robotics as a cornerstone of its future growth strategy. The transaction, pending standard regulatory clearances, is projected to conclude sometime between the middle and end of 2026.

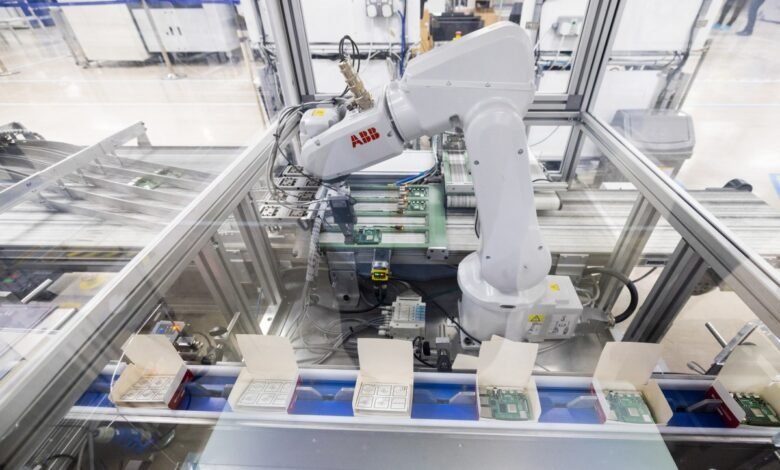

Headquartered in Zurich, the ABB robotics unit employs approximately 7,000 people and specializes in manufacturing industrial robots for a wide array of applications. These include intricate tasks such as precision picking, surface cleaning, and automated painting. For the year 2024, the business generated revenues of $2.3 billion, which accounted for about 7% of ABB’s total corporate revenue. ABB had initially revealed its intention to spin off this robotics group back in April.

A key objective for SoftBank is to revitalize the sales trajectory of the newly acquired entity. The unit’s 2024 revenue of $2.3 billion actually reflects a decrease from the $2.5 billion it reported the previous year, indicating an area where SoftBank believes it can drive significant improvement. Following the completion of the acquisition, Sami Atiya, the current president of the ABB robotics business, is scheduled to depart from the company.

This move is the latest in a series of calculated steps by SoftBank to cement its standing in the robotics industry. Over recent years, the firm has strategically invested in a diverse range of companies within the sector. Its portfolio includes established industry players like AutoStore, as well as promising startups such as Skild AI and Agile Robots. Furthermore, SoftBank has its own operational arm, the SoftBank Robotics Group, which was launched a decade ago in 2014.

Masayoshi Son, SoftBank’s visionary Chairman and CEO, articulated the company’s ambitious direction in an official statement. He proclaimed that “SoftBank’s next frontier is physical AI,” and expressed his conviction that by joining forces with ABB Robotics, they can “unite world-class technology and talent under our shared vision to fuse Artificial Super Intelligence and robotics.” He believes this powerful combination will trigger a groundbreaking evolution with the potential to propel all of humanity forward.

For SoftBank, robotics represents one of four critical, interconnected focus areas that also encompass AI chips, AI data centers, and energy solutions. The company’s strategic outlook suggests that the core of the ongoing “Information Revolution” is continuously shifting. It has progressed from personal computers and the internet to broadband and smartphones, and is now decisively entering a new era dominated by artificial intelligence. In this context, SoftBank has formally declared its corporate mission to be the realization of artificial super intelligence (ASI) dedicated to the advancement of human society.

(Source: TechCrunch)