Nuvo Secures $34M From Sequoia & Spark for B2B Trade Network

▼ Summary

– Nuvo, a San Francisco startup, raised $34 million in Series A funding from Sequoia Capital and Spark Capital to revolutionize B2B commerce with a digital platform replacing outdated methods like faxes and emails.

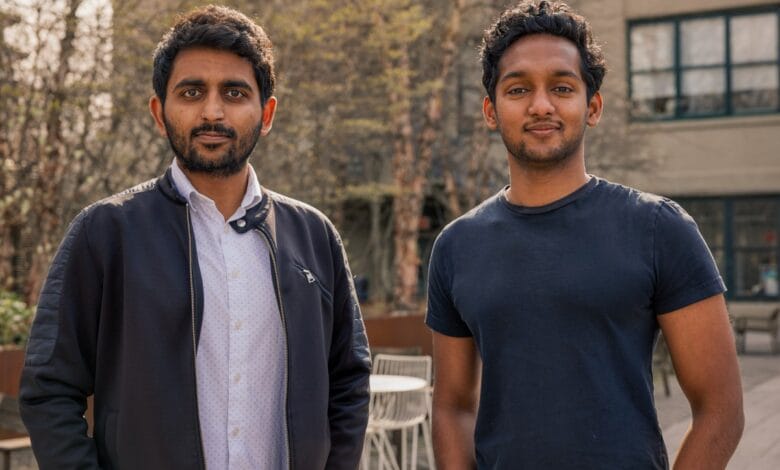

– Founded in 2021 by Sid Malladi and Rameez Remsudeen, Nuvo functions like LinkedIn for B2B trade, addressing inefficiencies in the $11 trillion U.S. trade industry by enabling verified profiles and trusted partnerships.

– The Series A follows an $11 million seed round led by Founders Fund and Index Ventures, with additional backing from Foundation Capital, Human Capital, Susa Ventures, and angel investors like Max Mullen and Ryan Petersen.

– Nuvo’s platform reduces fraud and administrative burdens by verifying trade partners, accessing credit reports, and digitizing transactions, with potential scalability likened to PayPal and Stripe by Sequoia’s Bryan Schreier.

– Nuvo plans to expand into new industries and international markets, adding features like AI-driven insights and integrated payments, aiming to redefine B2B collaboration amid economic shifts and tariff changes.

Nuvo, a San Francisco-based startup revolutionizing B2B commerce, has secured $34 million in Series A funding from heavyweight investors Sequoia Capital and Spark Capital. The company’s innovative platform, designed to modernize how businesses connect and trade physical goods, aims to replace outdated methods like faxes and emails with a streamlined, digital approach.

Founded in 2021 by CEO Sid Malladi and CTO Rameez Remsudeen, Nuvo functions like a LinkedIn for B2B trade, allowing companies to create verified profiles and establish trusted partnerships. The platform addresses inefficiencies in the $11 trillion U.S. trade industry, where businesses still rely on manual processes for purchasing lumber, electronic components, and other goods.

The latest funding round follows an $11 million seed investment led by Founders Fund and Index Ventures in early 2022. Additional backers include Foundation Capital, Human Capital, and Susa Ventures, alongside prominent angel investors like Instacart’s Max Mullen and Flexport’s Ryan Petersen.

Nuvo’s platform enables businesses to verify trade partners in real time, access credit reports, and streamline purchasing workflows. By digitizing traditionally paper-heavy transactions, the company reduces fraud risks and administrative burdens. Bryan Schreier, a partner at Sequoia, likened Nuvo’s potential to industry giants like PayPal and Stripe, citing its ability to scale through network effects as more buyers and sellers join.

Unlike competitors such as HighRadius, Nuvo operates as a network-first solution, fostering connections rather than functioning as standalone software. The company already counts major brands like Great Dane, Southern Glazer’s Wine & Spirits, and Fender among its 50,000-strong trade network.

Currently serving industries like alcohol, building materials, and manufacturing, Nuvo plans to expand into new verticals while adding features like AI-driven insights and integrated payments. International growth is also on the horizon, with markets in Latin America, Europe, and Asia-Pacific under consideration.

With tariffs and economic shifts increasing the need for agile trade solutions, Nuvo’s platform could redefine how businesses collaborate—turning fragmented, manual processes into a seamless digital marketplace.

(Source: TechCrunch)