Reuters Digital News Report: Analyzing Trends in News Consumption and Monetization

- Trust in News Continues Troubling Decline Across Markets

- Young Audiences Pivoting to Visual and Platform-Centric News Formats

- Economic Turbulence Creates Brutal Operating Environment for Publishers

- Audiences Overwhelmed by Options Fueling Fatigue and Avoidance

- Bold Product Innovations and Audience Focus Vital to Rebuild Relevance

- Reasserting Journalism's Public Service Mission Key to Forging Sustainable Path

‘The Digital News Report 2023′, authored by Nic Newman (Senior Research Associate), Dr. Richard Fletcher, Dr. Kirsten Eddy, Dr. Craig T. Robertson, and Prof. Rasmus Kleis Nielsen (Director of the Reuters Institute for the Study of Journalism), provides a comprehensive analysis of the rapidly evolving digital news landscape. This comprehensive report, surveying 46 markets across the globe, exposes declining levels of news engagement, eroding public trust, and substantial business pressures facing publishers.

Despite some individual success stories in building online audiences and subscriptions, the report’s data illustrates the fragility of these gains against economic headwinds, fragmenting audiences, and disruptive platform dynamics. Even leading brands struggle to convince consumers that their journalism is worth paying attention to, let alone paying for directly.

The report highlights several concerning trends – interest in news continues to wane, fueling disengagement and selective avoidance of topics like the Ukraine war. Trust in media has fallen further across markets. And the combined impact of rising costs and falling revenues presents an extremely challenging environment for many publishers.

Looking ahead, the report signals significant shifts in audience behavior on the horizon, especially among younger demographics. This includes preferences for more accessible, informal, and entertaining news formats delivered via platforms like YouTube, Instagram and TikTok rather than traditional text articles. Audio and visual formats are projected to become a more vital part of the mix over the next decade.

As the abundance of content channels and options overwhelms consumers, the report emphasizes the urgent need for journalism to reassert its relevance, accuracy and humanity. Building trust and forging stronger audience connections will require innovations in storytelling, business models and distribution strategies to cut through the noise and clutter. The challenges are immense, but a relentless focus on meeting audience needs could help chart a sustainable path forward for the news industry.

In the following we will be hilighting on the report’s key findings, focusing on the interpretation of the infographics presented.

Platform Shifts and Implications

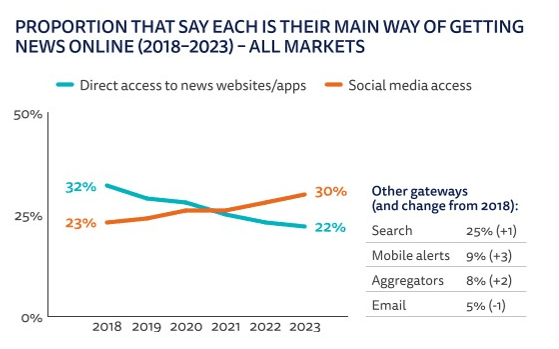

The report highlights the accelerating shift towards digital, mobile, and platform-dominated media environments, driven by younger generations’ reliance on various digital media platforms. Direct access to news websites and apps has declined, with social media becoming the primary gateway for news consumption, especially among younger audiences

Social Media Fragmentation and News Consumption

While Facebook remains a dominant social media platform overall, its influence on journalism is waning as it shifts focus away from news. The rise of video-centric platforms like YouTube and TikTok, particularly among younger demographics, has fragmented the social media landscape

Notably, audiences pay more attention to influencers, celebrities, and social media personalities than journalists on platforms like TikTok, Instagram, and Snapchat when it comes to news consumption. This contrasts with platforms like Facebook and Twitter, where traditional news media and journalists remain central to news conversations. Different platforms cater to varied news interests, with TikTok users in some countries being more likely to consume political news compared to others.

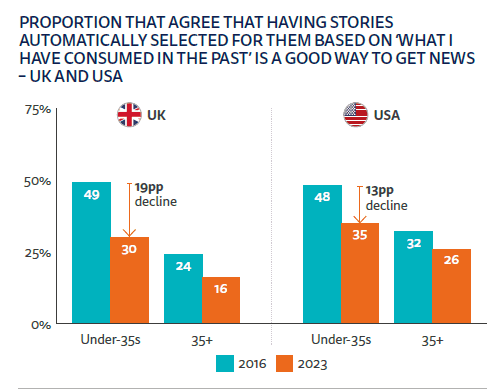

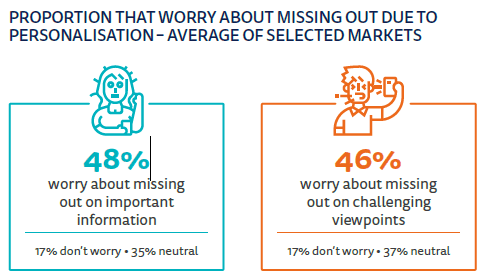

Algorithmic Curation and Misinformation Concerns

The report highlights growing skepticism towards algorithmic curation of news content based on users’ previous consumption. Many users express concerns about missing important information or diverse viewpoints due to personalization algorithms.

Furthermore, over half of the respondents (56%) worry about identifying misinformation on the internet when it comes to news, reflecting heightened concerns about the spread of misinformation, particularly on social media platforms. The types of misinformation seen vary across countries, with some reporting higher levels of misinformation related to specific topics like the Ukraine conflict or climate change.

News Participation and Engagement

The report reveals a decline in open participation and engagement with news, such as sharing and commenting. A relatively small group of active users has a disproportionate influence on political and cultural debates, and this group has become smaller and more concentrated over time. Across markets, only around a fifth (22%) are now active participators, with around half (47%) not participating in news at all.

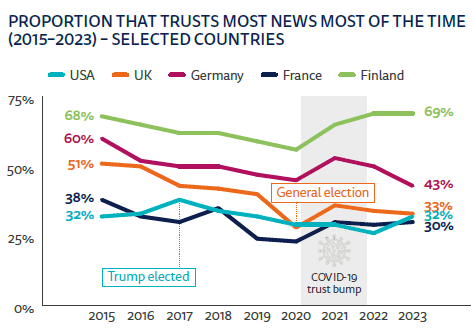

Trust in News and the Role of Public Media

Trust in news has fallen by 2 percentage points across markets in the last year, reversing gains made during the COVID-19 pandemic (discussed in the text). Public media brands enjoy high levels of trust in many Northern European countries, but their reach has been declining among younger audiences, highlighting the importance of maintaining broad public service reach for future legitimacy.

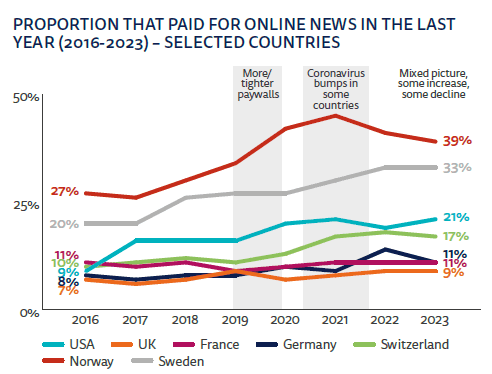

News Subscriptions and Monetization

The growth in online news payments may be leveling off, with the proportion paying for any online news remaining at 17% across a basket of 20 richer countries. The cost-of-living crisis has influenced subscription dynamics, with many users canceling, renegotiating, or exploring trial offers to reduce expenses.

Access to quality and distinctive journalism remains the primary reason for subscribing, while brand identification and supporting good journalism are also important factors. However, a significant portion of non-subscribers (42%) indicate that nothing would persuade them to pay for online news.

The report also examines news consumption related to personal finances and the economy. Although people rely greatly on mainstream media for finance and economic news, around a third (30%) found it difficult to understand, especially those most affected by the cost-of-living crisis.

Interest in News Continues to Decline, Fuelling Disengagement

Unlike the COVID-19 pandemic, neither the cost-of-living crisis nor the ongoing Ukraine war has led to a sustained upsurge of news consumption. Across countries, survey data show a decline in weekly news consumption across different sources over the last year and lower interest in news overall.

Self-declared interest in news is lower among women and younger people, with the falls often greatest in countries with high political polarization. Some stable markets like Finland have largely bucked the trend, while others like Austria and Germany are starting to be affected.

These declines are reflected in lower consumption of traditional and online media sources, with the highest proportion of ‘disconnected’ users found in Japan (17%), the United States (12%), Germany and the UK (9% each) (discussed in text).

Addressing Selective News Avoidance

Last year’s report highlighted selective news avoidance, especially among hard-to-reach groups. This year’s data finds continued high levels of selective avoidance (36%), with around half of avoiders (53%) trying periodic avoidance like turning off news or scrolling past it on social media. Another group (52%) checks news less often or avoids certain topics (32%) like the Ukraine war or national politics.

Avoidance is driven by factors like excessive repetition, emotional draining, and bitter political debates. Selective avoidance of Ukraine news was highest in countries closest to the conflict, likely due to overexposure or a desire to protect mental health. In the US, those on the right were more likely to avoid topics like climate change and social justice issues.

News organizations are exploring approaches like making news more accessible, broadening the agenda, embracing constructive journalism, and focusing on inspiring stories to address avoidance (Graph 35). However, audiences still prefer twists on big stories over constructive approaches.

Trust in News Continues Downward Path

Overall trust in news (40%) and trust in sources used (46%) are down by 2 percentage points, with some exceptions like a 6pp increase in the US under Biden. Trust remains lowest in polarized countries like the US (32%), Argentina (30%), Hungary (25%), and Greece (19%).

The report highlights how widespread criticism of the media from politicians, ordinary people, and commentators on polarized outlets may contribute to low trust, especially in countries with high distrust like Greece and the US.

Public Service Media Under Pressure

Public service media (PSM) have faced increased criticism and funding pressures. While seen as important in most countries, perceived importance is lower among younger audiences who prefer digital media, those with lower education levels, and those on the political right, undermining long-term legitimacy.

The Growing Importance of Multimedia Formats

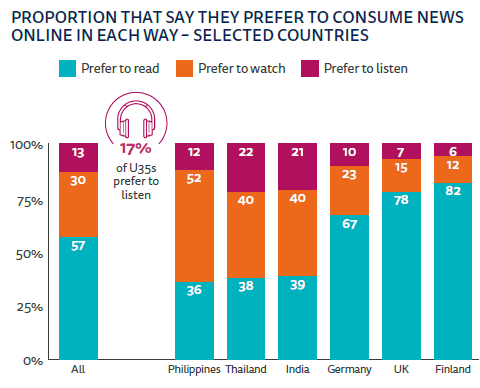

The report explores preferences for text, audio, and video consumption of online news. While most still prefer text (57%), younger audiences have a stronger preference for video (30%) and audio (17%) formats, especially in Asian countries like India, Thailand and the Philippines.

Video news consumption is higher in countries like Kenya (97%), the Philippines (94%), and Thailand (91%), compared to the UK (46%) and Germany (45%). Two-thirds (62%) consumed news video via social media, but under-35s are shifting more toward TikTok alongside YouTube and Facebook.

Podcast Reach Remains Stable

Around a third (34%) access podcasts monthly across 20 countries, with news podcasts reaching 12% regularly. The US (19%) and Australia have seen the strongest podcast growth, while the UK lags at 8% for news podcasts.

Notable podcasts include the New York Times’ The Daily in the US, DR’s Genstart in Denmark, and the BBC’s Newscast facing competition in the UK. Many podcasts are now being filmed for video platforms too.

Conclusions

The Digital News Report 2023 paints a sobering picture of the significant obstacles facing the news industry around the world. While a few leading brands have found success building digital audiences and revenues, the overall trends reveal a more fragile reality as economic pressures, audience fragmentation, and platform disruptions erode past gains.

In the short-term, escalating costs and falling ad revenues resulting from economic turbulence have created an extremely challenging operating environment for many publishers. Longer-term, the data signals deeper shifts in audience behavior and preferences, especially among younger demographics. The continued rise of visual and audio formats, along with a marked preference for more accessible, informal and entertaining content delivered via platforms like YouTube, Instagram and TikTok, threatens to undermine the traditional text-based online article.

Perhaps most concerning is the widespread sense of disengagement, confusion and fatigue evident across markets. Many news avoiders feel overwhelmed by an abundance of sources and channels. Interest in major news events like the Ukraine war has rapidly waned for some. And trust in media has deteriorated further amid a relentless cycle of criticism and misinformation.

Stemming this worrying tide of disconnect between journalism and audiences will require bold innovations in storytelling, product development and distribution strategies. The report emphasizes an urgent need for the news industry to reassert its relevance, accuracy and essential public service mission. Building stronger community connections and proving real value to consumers must take precedence over the pursuit of clicks and will ultimately be vital for forging sustainable digital business models.

There are no easy solutions, but a ruthless focus on understanding and serving the disparate needs of diverse audiences could help chart a new path forward. Cutting through the ambient noise and information clutter by providing accurate, explanatory and solutions-oriented journalism tailored to specific segments offers one possible way to rebuild public trust and engagement. Embracing flexibility, investing in multimedia capabilities and leveraging both proprietary channels and third-party platforms will all be critical components of a successful digital strategy.

The challenges revealed in this year’s report are immense. But by redoubling efforts to deliver on journalism’s unique public service mission in accessible, innovative ways, the news industry may yet be able to stem its fragile trajectory and forge a more sustainable future.