AI Shopping Assistants Launch, But Rivals Remain Unfazed

▼ Summary

– OpenAI and Perplexity have launched similar AI shopping features in their chatbots to help users research purchases, such as finding products based on specific criteria or photos.

– Adobe predicts a 520% growth in AI-assisted online shopping this holiday season, potentially benefiting startups like Phia and Cherry but raising concerns about competition from larger companies.

– Experts believe specialized AI shopping startups with niche datasets, like those in fashion or interior design, will provide better experiences than general-purpose tools by using domain-specific data.

– OpenAI and Perplexity have advantages through existing user bases and partnerships with retailers like Shopify and PayPal, enabling in-chat checkouts, while smaller startups often rely on affiliate revenue.

– If AI shopping tools rely on generic search indexes without specialized data, they may struggle to compete and could worsen existing search issues, whereas vertical models tailored to specific industries are expected to outperform.

As the holiday shopping season approaches, major tech players are introducing new artificial intelligence tools designed to transform how consumers find and purchase products online. OpenAI and Perplexity have both launched AI shopping features this week, integrating these capabilities directly into their existing chatbot platforms. These developments arrive alongside projections from Adobe predicting a staggering 520% growth in AI-assisted online shopping this holiday period, creating both opportunities and challenges for specialized AI shopping startups.

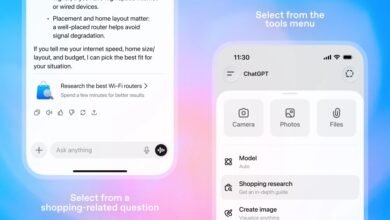

OpenAI’s implementation allows ChatGPT users to request specific product recommendations, such as locating a gaming laptop under $1000 with a screen larger than fifteen inches. Alternatively, shoppers can upload photographs of premium clothing items and ask the AI to find similar styles at more affordable price points. Perplexity emphasizes how its chatbot’s memory function enhances shopping searches by personalizing recommendations based on previously shared user information, including geographic location and professional background.

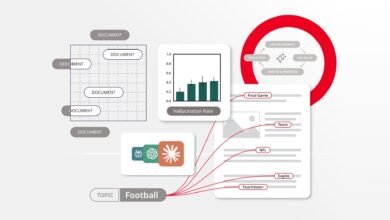

This expansion into e-commerce by established AI companies raises questions about the future of specialized shopping startups like Phia, Cherry, and Deft. However, industry leaders from niche platforms remain confident about their competitive positioning. Zach Hudson, CEO of interior design shopping tool Onton, believes specialized AI shopping services deliver superior experiences compared to general-purpose tools. “Any model or knowledge graph is only as good as its data sources,” Hudson explained. He noted that ChatGPT and similar large language model tools currently rely on existing search indexes from Bing or Google, making them only as effective as the top results from those platforms.

Julie Bornstein, CEO of Daydream and an e-commerce veteran, shares this perspective, having previously described traditional search as “the forgotten child” of the fashion industry due to its historical shortcomings. “Fashion represents a uniquely nuanced and emotional shopping experience,” Bornstein commented. “Discovering a dress you love differs significantly from finding a television. That deeper understanding necessary for fashion shopping stems from domain-specific data and merchandising logic that comprehends silhouettes, fabrics, occasions, and how people assemble outfits over time.”

Specialized AI shopping companies develop proprietary datasets specifically trained on higher-quality information relevant to their verticals. This focused approach proves more manageable when cataloging specific categories like fashion or furniture rather than attempting to encompass all human knowledge. Onton, for instance, created a specialized data pipeline to systematically organize hundreds of thousands of interior design products, resulting in better-trained internal models. Hudson suggests that without this level of specialization, startups will struggle to distinguish themselves. “If you’re using only off-the-shelf LLMs and a conversational interface, it’s very hard to see how a startup can compete with the larger companies,” he observed.

The established AI companies nevertheless possess significant advantages, including existing user bases and the scale to secure partnerships with major retailers from the outset. While specialized platforms like Daydream and Phia typically redirect customers to retailers’ websites, sometimes earning affiliate revenue, OpenAI and Perplexity have integrated with Shopify and PayPal respectively, enabling transactions within their conversational interfaces.

These large AI operations, which require enormous computational resources, continue exploring paths to profitability. Following the blueprint established by Google and Amazon, e-commerce presents a logical revenue stream through retailer-paid advertising within search results. However, this approach risks amplifying existing customer frustrations with commercialized search experiences.

Bornstein maintains that specialized approaches will ultimately deliver better consumer outcomes. “Vertical models, whether in fashion, travel, or home goods, will outperform because they’re tuned to real consumer decision-making,” she affirmed, highlighting the enduring value of domain-specific expertise in the evolving landscape of AI-powered shopping.

(Source: TechCrunch)