OpenEvidence, AI for Doctors, Raises $200M at $6B Valuation

▼ Summary

– OpenEvidence is raising $200 million at a $6 billion valuation, as reported by The New York Times.

– This funding follows a $210 million round three months prior, showing strong investor interest in specialized AI.

– The platform uses medical journals to help healthcare professionals quickly access medical knowledge for patient care.

– OpenEvidence’s monthly clinical consultations have nearly doubled to 15 million since July 2024.

– The investment round is led by Google Ventures with participation from several major venture capital firms.

A new wave of artificial intelligence is making significant strides in healthcare, with OpenEvidence securing a massive $200 million investment that values the company at an impressive $6 billion. This substantial funding round arrives just three months after the company collected $210 million at a $3.5 billion valuation, highlighting the powerful momentum and investor confidence surrounding specialized AI tools designed for professional use.

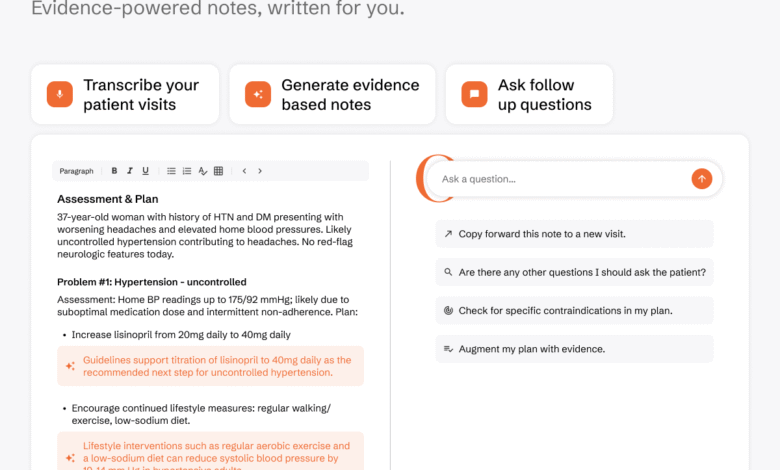

Often described by physicians and nurses as a medical version of ChatGPT, OpenEvidence provides verified healthcare professionals with a free, advertising-supported platform to rapidly access and apply established medical knowledge. The system draws from highly respected sources, including the Journal of the American Medical Association (JAMA) and the New England Journal of Medicine, enabling clinicians to find reliable answers that support patient care decisions.

Since its launch in 2022, the startup has experienced remarkable growth. The number of clinical consultations processed through its platform each month has surged, nearly doubling since July to reach a current total of 15 million monthly interactions. This rapid adoption underscores the tool’s utility and the growing reliance on AI assistance in clinical environments.

The latest funding effort was spearheaded by Google Ventures, with significant contributions from a prestigious group of backers. Other participants in the round included Sequoia Capital, Kleiner Perkins, Blackstone, Thrive Capital, Coatue Management, Bond, and Craft, forming a powerful consortium of venture capital and investment firms.

(Source: TechCrunch)