Nvidia’s AI Startup Investments: Powering the Future

▼ Summary

– Nvidia has dramatically increased its revenue, profitability, and market capitalization to $4.5 trillion since the AI boom began over two years ago.

– The company has significantly accelerated its startup investments, completing 50 venture deals in 2025 alone, surpassing its 2024 total of 48 deals.

– Nvidia’s corporate investing strategy aims to expand the AI ecosystem by backing startups it considers “game changers and market makers.”

– It has invested in numerous high-profile AI startups, including OpenAI, xAI, Mistral AI, and Figure AI, often participating in funding rounds exceeding $100 million.

– These investments span various AI sectors, from autonomous vehicles and robotics to healthcare and data centers, extending Nvidia’s influence beyond just supplying its products.

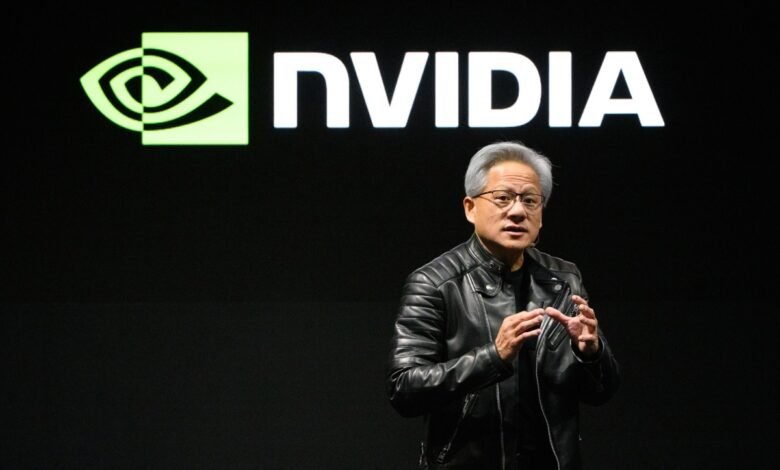

Nvidia has emerged as the undisputed titan of the artificial intelligence era, leveraging its dominant position in high-performance GPUs to fuel an unprecedented investment spree into the most promising AI startups worldwide. The company’s strategic moves are not merely financial; they are a calculated effort to cultivate and control the entire AI ecosystem. Since the debut of ChatGPT ignited the generative AI boom, Nvidia’s financial power has grown exponentially, transforming it into a multi-trillion dollar behemoth with the resources to shape the industry’s future.

This financial strength is being channeled directly into venture capital. Data from PitchBook reveals that Nvidia has already been involved in 50 startup deals in 2025, surpassing its total from the entire previous year. This figure does not even include the separate, accelerated activity of its official corporate venture arm, NVentures. The company’s stated mission for these investments is to back what it deems “game changers and market makers,” effectively using its capital to expand the frontiers of AI.

The scale of Nvidia’s ambition is clear from its participation in massive funding rounds, particularly those exceeding $100 million. The following overview, organized by funding amount, illustrates the vast and diverse reach of Nvidia’s investment strategy.

The Billion-Dollar Investment Club

OpenAI: In a landmark move, Nvidia invested $100 million in OpenAI during a colossal $6.6 billion funding round in October 2024. While this was a smaller commitment compared to other backers, Nvidia later announced a monumental strategic partnership, pledging to invest up to $100 billion over time to develop massive AI infrastructure.

xAI: Defying pressure from other investors, Nvidia participated in Elon Musk’s xAI $6 billion round in December 2024. Reports indicate the chipmaker is also set to invest up to $2 billion in the equity portion of a planned $20 billion round, a deal structured to help xAI acquire more Nvidia hardware.

Mistral AI: Nvidia made its third investment in the French LLM developer during its €1.7 billion Series C in September, which valued the company at €11.7 billion.

Reflection AI: Nvidia led a $2 billion funding round for this one-year-old startup in October, establishing it as a U.S. competitor to China’s DeepSeek with an $8 billion valuation.

Thinking Machines Lab: The chipmaker joined a long list of investors backing former OpenAI CTO Mira Murati’s new venture, which secured a $2 billion seed round at a $12 billion valuation in July.

Inflection: One of Nvidia’s early major bets, this company co-founded by DeepMind’s Mustafa Suleyman, raised $1.3 billion in June 2023. In a twist, Microsoft later hired its founders and licensed its technology for $620 million, leaving the original company with a diminished role.

Nscale: After a $1.1 billion round in September, Nvidia also participated in Nscale’s $433 million SAFE note funding in October. The startup, building data centers for OpenAI’s Stargate project, was spun out of a cryptocurrency mining firm.

Wayve: Nvidia joined a $1.05 billion round for this UK-based autonomous driving company in May 2024, with plans to invest an additional $500 million. Wayve is testing its self-learning vehicles in the UK and San Francisco.

Figure AI: The chipmaker invested in Figure AI’s over $1 billion Series C in September, valuing the humanoid robotics firm at $39 billion. This followed an initial investment in a $675 million Series B earlier in the year.

Scale AI: Nvidia, alongside Amazon and Meta, invested $1 billion in this data-labeling service provider in May 2024, valuing it at nearly $14 billion. Shortly after, Meta invested $14.3 billion for a major stake and hired away the CEO and key staff.

The Hundreds-of-Millions Club

Commonwealth Fusion: Nvidia backed this nuclear fusion startup’s $863 million round in August 2025, valuing the company at $3 billion.

Crusoe: The chipmaker was among the investors in this data center startup’s $686 million raise in November 2024.

Cohere: Nvidia has consistently backed this enterprise LLM provider, including in its $500 million Series D in August, which valued Cohere at $6.8 billion.

Perplexity: An early investor since 2023, Nvidia participated in most of the AI search engine’s funding rounds, including a $500 million round in December 2024 and a July round that valued the company at $18 billion.

Poolside: Nvidia joined Bain Capital Ventures in a $500 million round for this AI coding assistant in October 2024, resulting in a $3 billion valuation.

Lambda: This AI cloud provider, which rents servers powered by Nvidia GPUs, raised a $480 million Series D in February at a $2.5 billion valuation, with Nvidia’s participation.

CoreWeave: Although now public, Nvidia invested in this GPU-cloud provider back in April 2023 when it was still a startup, raising $221 million.

Together AI: Nvidia participated in this company’s $305 million Series B in February, valuing the cloud-based AI infrastructure firm at $3.3 billion.

Firmus Technologies: The Singapore-based data center company received A$330 million (approx. $215 million USD) in September from investors including Nvidia, for its energy-efficient ‘AI factory’ project in Tasmania.

Sakana AI: Nvidia invested in this Japan-based startup’s $214 million Series A in September 2024, valuing the company at $1.5 billion.

Nuro: The chipmaker joined a $203 million round for this self-driving delivery startup in August, which valued Nuro at $6 billion.

Imbue: This AI research lab, focused on reasoning systems, raised a $200 million round in September 2023 with Nvidia’s backing.

Waabi: Nvidia invested in this autonomous trucking startup’s $200 million Series B in June 2024, a round co-led by Uber and Khosla Ventures.

Deals Over $100 Million

Ayar Labs: Nvidia invested in this optical interconnects developer’s $155 million round in December, marking its third investment in the company.

Kore.ai: This enterprise chatbot developer raised $150 million in December 2023 with Nvidia’s participation.

Sandbox AQ: Nvidia and Google invested $150 million in this startup developing large quantitative models in April, boosting its Series E to $450 million and its valuation to $5.75 billion.

Hippocratic AI: Nvidia joined a $141 million Series B in January for this healthcare-focused LLM company, which is valued at $1.64 billion.

Weka: The chipmaker invested in a $140 million round for this AI-native data platform in May 2024, valuing it at $1.6 billion.

Runway: Nvidia participated in a $308 million round for this generative AI media company in April, which valued it at $3.55 billion.

Bright Machines: Nvidia joined a $126 million Series C for this smart robotics and AI software startup in June 2024.

Enfabrica: The chipmaker invested in this networking chips designer’s $125 million Series B in September 2023.

Reka AI: Nvidia and Snowflake backed this AI research lab’s $110 million round in July, tripling its valuation to over $1 billion.

(Source: TechCrunch)